AT&T announced stellar third-quarter earnings and revenue

The shares of AT&T Inc (NYSE:T) are surging this afternoon, last seen up 7.8% at $15.43, after the telecommunications giant reported third-quarter earnings and revenue that beat Wall Street’s expectations.

Unsurprisingly, options traders are targeting the security at four times the intraday average volume. So far, 104,000 calls and 50,000 puts have been exchanged. The October 15.50 call is the most popular, followed by the 14 put in the same monthly series.

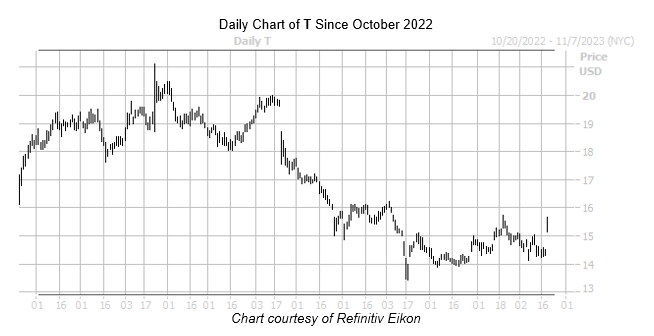

On the charts, this dip is helping T distance itself further from its mid-July, 30-year lows below the $13.50 area. Even after shedding 18.8% over the last nine months, the equity’s year-over-year deficit remains razor thin at -0.6%.

A broader looks shows calls have been unusually popular, per AT&T stock’s 10-day call/put volume ratio of 4.21 at the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX). This ratio stands higher than 81% of readings from the past year, indicating calls being picked up at a much faster-than-usual rate.

It’s also worth noting that the equity’s Schaeffer’s Volatility Scorecard (SVS) ranks at an elevated 95 out of 100, suggesting it exceeded option traders’ volatility expectations during the past year.

Image and article originally from www.schaeffersresearch.com. Read the original article here.