AI’s options volume is running at more than double its average intraday amount

The shares of C3.ai Inc (NASDAQ:AI) are surging today, up 13.6% to trade at $27.23 at last glance, on track for their best single-session gain since June 13. Although there’s no specific catalyst, today’s positive price action could be a halo lift thanks to strong earnings from data technology peer Palantir Technologies (PLTR). The breakout could also be shorts getting squeezed, considering a whopping 37.8% of the stock’s total available float is sold short.

Either way, options traders are chiming in on the move. So far today, 77,000 calls and 45,000 puts have been exchanged, which is 2.6 times the average daily options volume already. The November 20 put is the most popular, followed by the weekly 11/10 28-strike call, with new positions opening at both.

These options traders are in luck, too. AI’s Schaeffer’s Volatility Index (SVI) of 70% ranks in the low 6th percentile of its annual range, meaning options traders are pricing in relatively low volatility expectations at the moment.

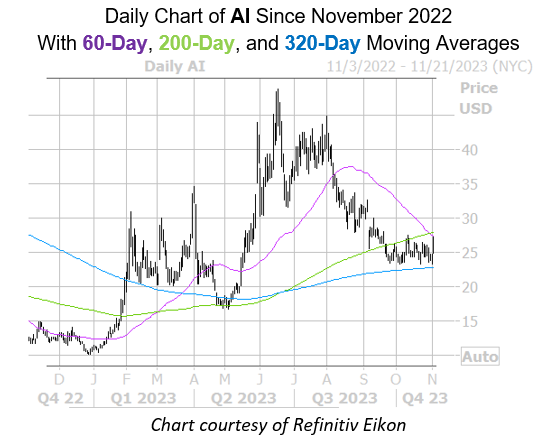

C3.ai stock has been consolidating around the $25 level since mid September, but still sports a hefty 144.5% year-to-date gain. The stock’s 60- and 200-day moving averages appear to be keeping a cap on today’s rally, while its 320-day moving average lingers below as support.

Image and article originally from www.schaeffersresearch.com. Read the original article here.