Subscribers to our new In-the-Money Countdown (ITMC) service scored a 101% profit with our BBY trade

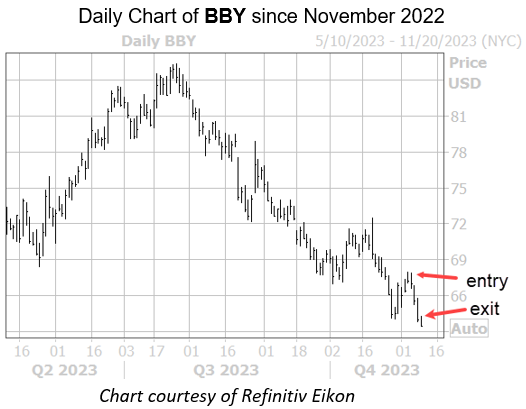

Subscribers to our new In-the-Money Countdown (ITMC) service scored a 101% profit in just three trading sessions with our Best Buy Co Inc (NYSE:BBY) weekly 11/10 70-strike put. We recommended this contract on Sunday, after the stock’s Friday close of $67.19.

At the end of last week, the electronics retailer formed a bearish candle below its descending 20-day moving average. And the $68 level, which was just overhead, coincides with the stock’s May and early-October lows, giving it potential for support turned resistance.

Furthermore, these resistance levels also coincide with the $15 billion market cap level. Combining open interest (OI) from the 11/0 and 11/17 series, there was also stacked put OI down to the 62 strike.

Today, the shares of BBY are sinking to 52-week lows, down 0.7% at $63.49 at last glance, and are on track for their fourth-straight daily loss since our recommendation. Since the start of the year, the equity is down 20.8%.

Options traders are in luck because trades like these can be had for a discount. Check out the link below to subscribe for our In-the-Money Countdown, which is currently running a one-month sale!

Image and article originally from www.schaeffersresearch.com. Read the original article here.