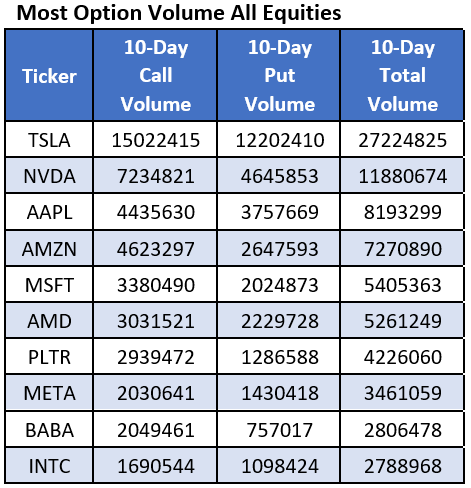

PLTR is on Schaeffer’s Senior Quantitative Analyst Rocky White’s list of stocks that attracted the highest weekly options volume in the last 10 days

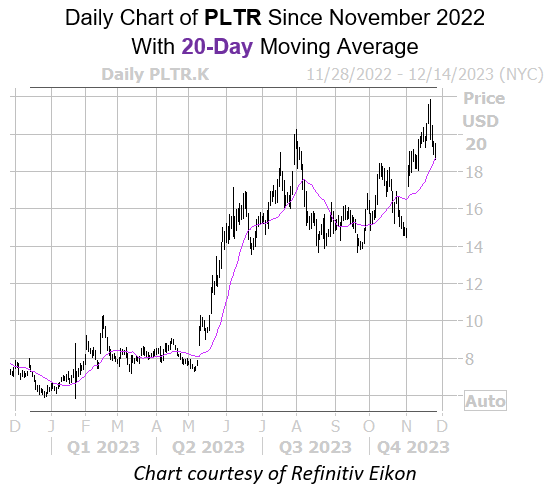

Software stock Palantir Technologies Inc (NYSE:PLTR) is in the midst of a dip on the charts, following its Nov. 21 two-year high of $21.85. Still, the stock is above its Nov. 2 post-earnings close of $17.97, after a 20.4% boost following its quarterly win, and up 198.7% since the start of the year. Plus, PLTR’s 20-day moving average appears to be keeping losses in check, with the stock hitting $18.62 at its lowest point today.

PLTR has stayed popular in the options pits amid its recent peak, landing on Schaeffer’s Senior Quantitative Analyst Rocky White’s list of stocks that have attracted the highest weekly options volume in the last 10 days. Sentiment amongst traders has been bullish, with Palantir Technologies stock seeing 2,939,472 calls and 1,286,588 puts exchanged during this time. The most popular contract over this period was the November 20.50 call, followed by the weekly 11/10 19.50-strike call.

These options traders are in luck at the moment, too. PLTR is seeing attractively priced premium at the moment, per its Schaeffer’s Volatility Index (SVI) of 52%, which ranks in the low 9th percentile of its annual range.

It’s also worth noting that though short interest has been slowly unwinding, down 7.1% over the last month, it still represents 8.1% of the stock’s available float. It would take shorts nearly three days to cover, at the security’s average pace of trading.

Image and article originally from www.schaeffersresearch.com. Read the original article here.