GME has seen 112,000 calls exchanged in the options pit so far today

Former meme stock GameStop Corp (NYSE:GME) is seeing heavy call volume today. Up 8.5% at $12.92 at last glance, and without a clear catalyst, the stock’s surge is likely the result of short selling, as short interest represents a hefty 22.5% of the stock’s available float.

So far today, 112,000 calls have crossed the tape — five times the amount typically seen at this point — in comparison to 22,000 puts. The weekly 12/8 20-strike call is the most popular, where new positions are being opened.

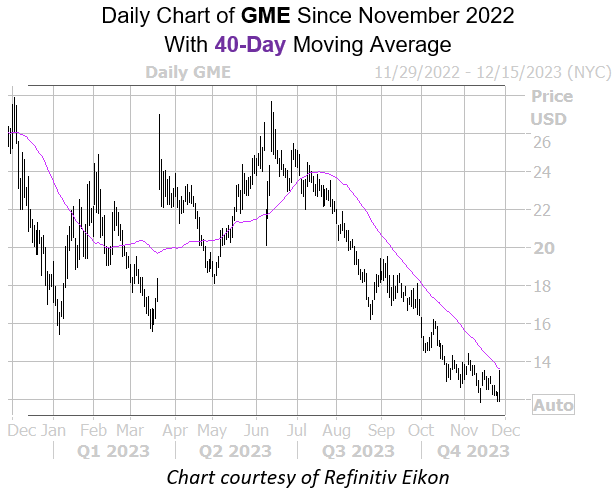

The $12 region, home to GME’s recent Nov. 13, two-year low of $11.82 has provided a floor on the charts for the past couple of days. The stock’s 40-day moving average lingers above as pressure, however. On track for its fifth-straight monthly loss, GameStop stock is down 29.8% since the start of the year, and call traders appear to be taking advantage of the extended pullback.

A broader look at the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX) shows GME’s 10-day call/put volume ratio of 4.11 ranks higher than 90% of readings from the past year. This points to plenty of optimism in the options pits over the past two weeks as well.

Image and article originally from www.schaeffersresearch.com. Read the original article here.