BioCryst Pharmaceuticals will resume trial enrollment of its blood disorder treatment

BioCryst Pharmaceuticals Inc (NASDAQ:BCRX) is soaring today, last seen up 22.5% at $13.65, after the drug maker said the U.S. Food and Drug Administration (FDA) lifted a partial clinic hold on its blood disorder treatment program. The company had originally paused clinical trials with BCX9930 amid the investigation of a waste product called serum creatinine in certain patients, but will now resume trial enrollment under new protocols and a reduced drug dose.

In response, call volume is running at 14 times the intraday average, with 22,000 calls across the tape so far. Meanwhile, only 1,890 puts have been exchanged, though volume is still at eight times what is typically seen at this point. The August 11 call is the most popular contract, followed by the 15 call in that same monthly series, with positions being opened at the latter.

Short-term options traders have been overwhelmingly bullish, too This is per the stock’s Schaeffer’s put/call open interest ratio (SOIR) of 0.17, which sits higher than just 4% of readings from the past year.

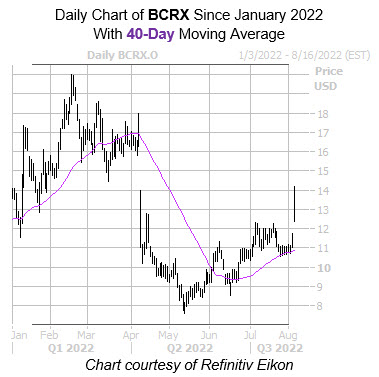

The shares are today trading at their highest level since April, after staging a bounce off the $10.50 region. The 40-day moving average reemerged as support in late June, with BioCryst Pharmaceuticals stock now traveling close to its year-to-date breakeven level, after adding nearly 40% in the last three months.

What’s more, the security looks ripe for a short squeeze. Short interest rose 6% in the last two reporting periods, and the 31.46 million shares sold short account for 17.5% of BCRX’s available float, which is equivalent to nearly two weeks’ worth of pent-up buying power.

Image and article originally from www.schaeffersresearch.com. Read the original article here.