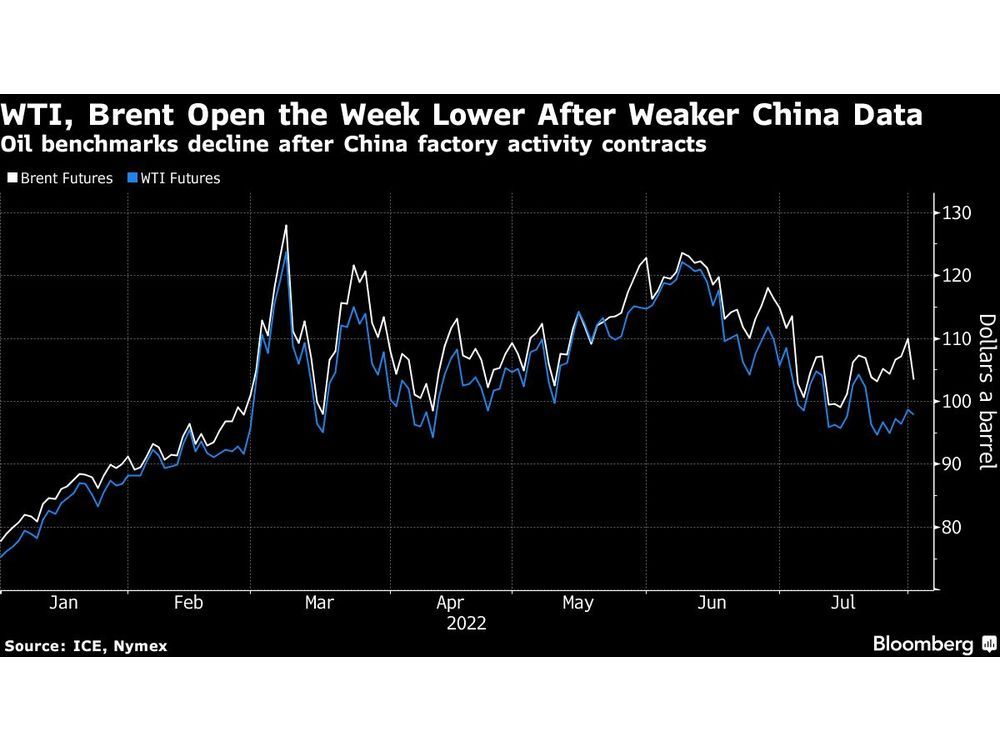

Oil fell as the week’s trading kicked off, after poor Chinese economic data added to concerns that a global slowdown may sap demand.

![f0lp{]jkbv[qdt7m5g1i2kcj_media_dl_1.png](https://moneywealthmatters.com/wp-content/uploads/2022/07/Oil-Declines-as-China-Slowdown-Spurs-Concern-Over-Demand-Outlook.jpg)

Article content

(Bloomberg) — Oil fell as the week’s trading kicked off, after poor Chinese economic data added to concerns that a global slowdown may sap demand.

Article content

West Texas Intermediate dropped toward $97 a barrel after sinking almost 7% in July in the first back-to-back monthly loss since late 2020. Weekend data indicated a surprise contraction in Chinese factory activity, highlighting the cost of Beijing’s preference for mobility curbs to tackle Covid-19.

Oil has seen volatile trading in recent months as concerns about a slowdown hurt demand for commodities even as underlying signals pointed to still-tight physical conditions. Data last week showed the US economy shrank for a second quarter, while the Federal Reserve hiked rates by 75 basis points.

“The fall in China’s manufacturing PMI was likely at the heart of the fall in oil prices,” said Vivek Dhar, director of mining and energy commodities research at Commonwealth Bank of Australia. The situation in China will reignite concern that global commodity consumption will continue to weaken, he said.

Article content

In Libya, meanwhile, crude output has rebounded after a series of disruptions that more than halved supply, according to the OPEC member’s oil minister. Nationwide production has returned to 1.2 million barrels a day, a level last seen in early April, Mohamed Oun said in a telephone interview.

Later this week investors will focus on a meeting of the Organization of Petroleum Exporting Countries and its allies including Russia, with the group setting policy for September. While the US has lobbied Saudi Arabia to loosen the taps to raise the pressure against Russia for the invasion of Ukraine, Moscow and Riyadh recently reaffirmed a joint commitment to a stable market.

Oil markets remain in backwardation, a bullish pattern marked by near-term prices trading above longer-dated ones. WTI’s prompt spread — the difference between its two nearest contracts — was $1.83 a barrel. That’s in line with the year-to-date average, but lower than a month ago.

Image and article originally from financialpost.com. Read the original article here.