Nvidia Corporation NVDA, a graphics chip manufacturer and investor favorite, reported in a filing with the Securities and Exchange Commission on Wednesday that the Biden administration has put restrictions in place that prevent the chip giant from selling its A100 and H100 chips to Russia and China, effective immediately.

A ‘$2-Billion Hit’ For Nvidia? The restrictions on Nvidia’s H100 and A100 chips — which are used to accelerate machine learning operations — signify an intensification of the U.S. crackdown on China’s technological power.

Related: Nvidia, AMD Shares Tumble As US Slaps Export Curbs on Top AI Chips To China: What’s At Risk Here?

In the filing, Nividia said it expects to lose $400 million — or 10.6% of its data center business and 6.8% of its overall third quarter revenues — over the newly imposed restrictions.

“My guestimate is this could potentially mean a $2-billion hit for 2023,” Stephanie Link, CIO and portfolio manager at Hightower Advisors, told Benzinga on Thursday.

“Markets hate uncertainty and this is a big one on a much loved stock – currently there are 37 sell side analyst buys (12 holds, 1 sell). Plus the stock isn’t cheap at 38x forward estimates – and those estimates are falling.”

Hayes Sees ‘Workaround’ For Nvidia: Analysts at KeyBanc Capital Markets issued a note on Wednesday following Nvidia’s announcement that offers a silver lining.

The China-based tech company Huawei faced similar restrictions several years ago and was able to backfill its losses with products not restricted by the requirement, according to KeyBanc.

Thomas Hayes, chairman and managing member of Great Hill Capital, said that could be the case with Nvidia too.

“It is expected there may be some type of workaround for NVDA as the chips in question are not easily translatable to military application,” Hayes told Benzinga on Thursday.

“But for now, it’s shoot first, ask questions later as people dump their stock.”

Nvidia Investors Pull Back: The sell-off has been deep for Nvidia shares on Thursday, with the stock down 11% midday as investors assess the unforeseen challenges the export restrictions will create for the company.

“There is real uncertainty with the timing of getting a license as well as what the revenue impact will be,” Link said.

“Semis are in a tough spot with double and tripling ordering going on (due to supply constraints) and certain end market weakness (notably gaming and PCs). This news won’t help the negative sentiment unfortunately. Tread carefully!” the CIO said.

In an update on Thursday, Nvidia said through March 1, 2023, American officials had granted it permission to carry out the exports necessary to support A100 customers in the U.S.

In addition, Nvidia said that through Sept. 1, 2023, the government had granted permission to use its Hong Kong facility to fulfill chip orders.

The Last Word: Jay Goldberg, CEO of D2D Advisory says the ban underscores deepening U.S.-China tensions over access to advanced chip technology.

“We’re going from blocking certain U.S. companies from supplying to a certain company, as was the case with Huawei, to banning certain U.S. products from selling to China, period,” Goldberg said.

Experts say the ban will affect China’s largest tech companies, including Alibaba Group Holding Ltd BABA, and Baidu Inc BIDU.

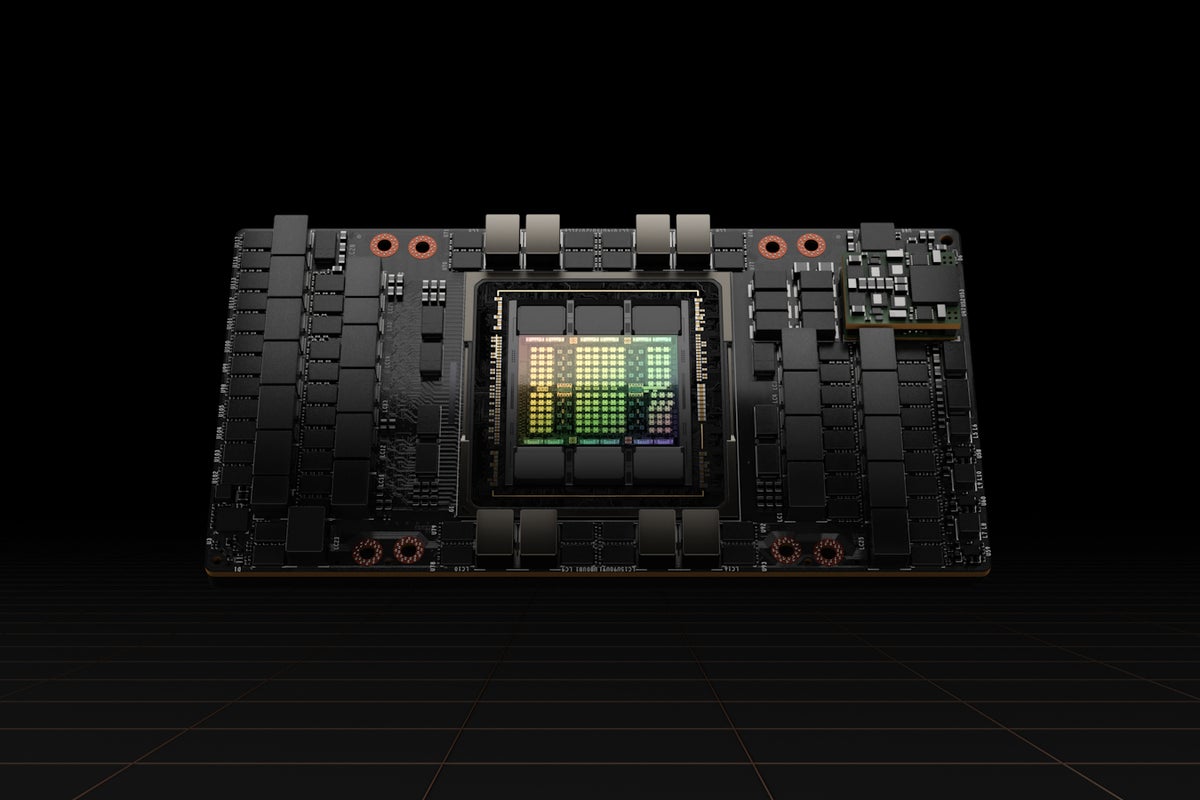

The Nvidia H100 GPU. Courtesy photo.

Image and article originally from www.benzinga.com. Read the original article here.