The steel sector has been in focus lately

This commentary first appeared on Forbes Great Speculations, where Schaeffer’s Investment Research is a regular contributor, on Wednesday, Dec. 20.

The steel sector has been in focus lately, after President Joe Biden’s re-election campaign adviser Brian Deese raised concerns about Nippon Steel’s acquisition of U.S. Steel (X).

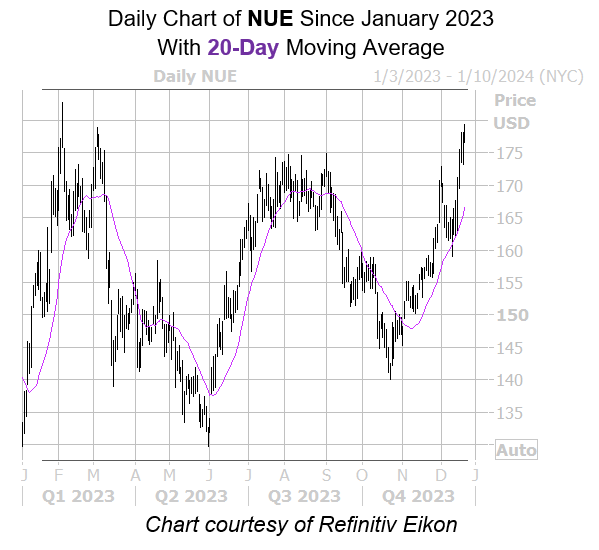

Nucor Corporation (NYSE:NUE) stock has been in rally mode since news of the acquisition broke on Monday, today hitting its highest level since February with support from its 20-day moving average. Better yet, the security looks ready to reach new heights as it builds upon its 35.4% year-to-date lead, thanks to a historically bullish signal.

The catalyst for additional gains could be historically low implied volatility (IV), which in combination with Nucor stock’s recent peak could generate tailwinds. Per Schaeffer’s Quantitative Analyst Rocky White, there were two other signals during the past five years when NUE was trading within 2% of its 52-week high, while its Schaeffer’s Volatility Index (SVI) ranked in the 20th percentile of its annual range or lower.

This is the case with the stock’s current SVI of 25%, which stands in the particularly low 2nd percentile of annual readings. The shares were higher one month later without fail, averaging an impressive 13% gain. From its current perch, a comparable move would place NUE at a record high of $201.18.

The equity looks overdue for a round of bull notes as well, with six of the nine analysts in question still calling Nucor stock a tepid “hold,” while the 12-month consensus target price of $175.50 is a slim discount to current levels.

Image and article originally from www.schaeffersresearch.com. Read the original article here.