Microsoft stock reports earnings after today’s close

Wall Street is eyeing earnings from several Big Tech names this week, with Microsoft Corporation (NASDAQ:MSFT) slated to step into the confessional after the close today. Analysts expect the company to turn in first-quarter earnings per share ranging from $2.15 to $2.29. Ahead of the event, MSFT is down 0.9% to trade at $279.30, and now trading near a historically bullish trendline.

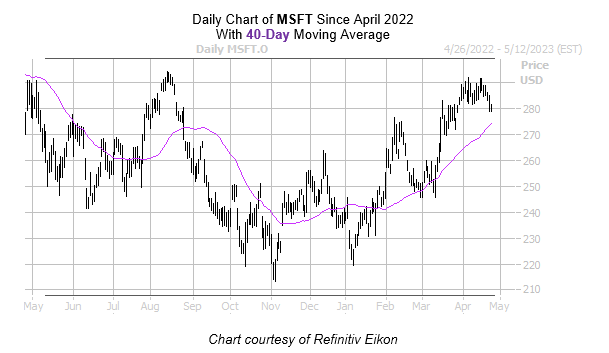

Specifically, Microsoft stock just pulled back to its 40-day moving average. According to data from Schaeffer’s Senior Quantitative Analyst Rocky White, six similar pullbacks occurred over the last three years, and the stock was higher one month later 83% of the time, averaging a 4.6% gain. From its current perch, a move of similar magnitude would put MSFT above $292.

The equity was rejected by the $292 level at the close on April 6, and the area has served as a ceiling on the charts ever since. Though it sports a marginal year-over-year deficit, Microsoft stock is up nearly 17% in 2023.

The security has a mixed post-earnings history based on the last eight quarters, and finished the next day lower after its last two reports. This time around, options traders are pricing in a 5.9% post-earnings swing for MSFT, which is slightly higher than the 3.7% move the stock averaged over the past two years, regardless of direction.

Options traders have focused on calls lately. At the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), Microsoft stock’s 10-day call/put volume ratio of 1.71 ranks in the 98th percentile of its annual range. This indicates an accelerated rate of call buying relative to put buying over the past two weeks.

Image and article originally from www.schaeffersresearch.com. Read the original article here.