Underscoring the magnitude of Big Tech’s influence on the year of 2023 options trading

Subscribers to Chart of the Week received this commentary on Sunday, December 10.

A rising tide lifts all boats, and that aphorism has never rung truer for Big Tech in 2023. With three weeks left in the year, market cap movement demonstrates just how ‘big’ Big Tech was in the last 12 months.

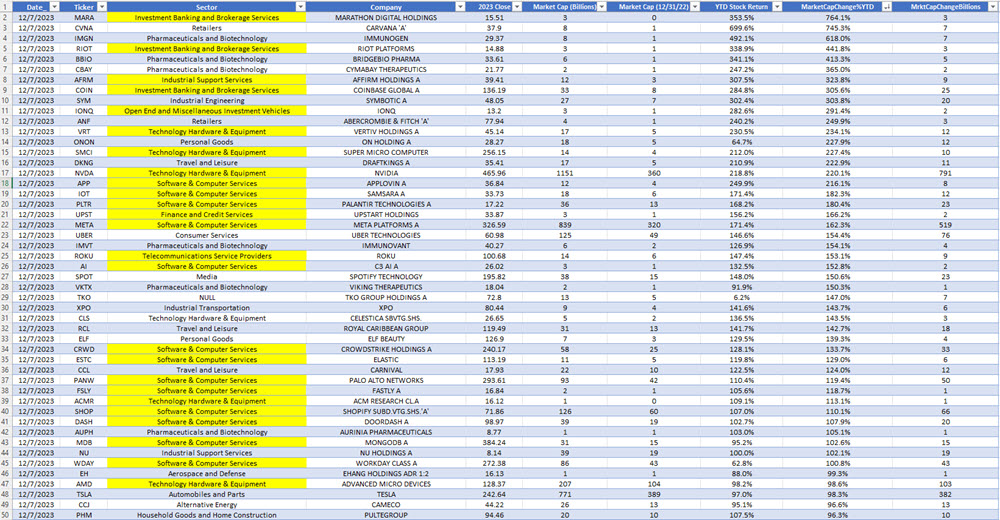

There’s a lot to unpack when you run down the market cap leaderboard, gathered by Senior Quantitative Analyst Rocky White and Senior Market Strategist Chris Prybal. The ‘Big Six’ of Apple (AAPL), Alphabet (AAPL), Microsoft (MSFT), Meta Platforms (META), Amazon.com (AMZN), and NVIDIA (NVDA) boast combined year-to-date stock gains of roughly 633%, as of this writing. Two companies entered the trillion dollar club, while the most valuable publicly traded company in the U.S. just celebrated a historic milestone. Microsoft and Apple added just shy of $1 trillion alone this year.

On Tuesday, Apple reclaimed the $3 trillion market cap level for the first time since August. Apple has battled with this psychological milestone three times in the last 12 months, but finishing out the week above this level is a substantial win that could now act as technical support heading into 2024.

Apple also shares the distinction of flashing a bullish signal on the charts. The stock’s new high this week comes amid historically low implied volatility (IV) — a combination that has been bullish for the stock in the past. Per data from White, there have been five other instances in the past five years when AAPL was trading within 2% of its 52-week high, while its Schaeffer’s Volatility Index (SVI) sat in the 20th annual percentile or lower — as is the case with the equity’s current SVI of 18%, in the 8th percentile of its 12-month range. The data shows that one month after those seven previous signals, Apple stock was up 3.6%, on average. From its current perch at $194.18, another move of that magnitude would put the shares above $300 for the first time ever since its 4-for-1 stock split in August 2020.

Microsoft stayed in second and on the same pace as Apple. Although there’s some scrutiny about OpenAI and antitrust regulation brought forth by the European Union (EU), a betting man would say Microsoft joins Apple in the $3 trillion club some time in 2024.

The only tech giant to have a better week than Apple was Alphabet (GOOGL). The stock added 5.3% on Thursday after unveiling Gemini, the company’s multimodal artificial intelligence. The upbeat reaction – one that lifted the Nasdaq-100 Index (NDX) 1% — is a stark difference from the bumbled rollout of Google’s Bard chatbot on Feb. 8, that saw GOOGL drop 7.7% and throw away $100 billion in market value.

Rounding out club trillion, AMZN is up 74.5% in 2023, saw the third-highest year-to-date swell in its market cap of the big six, and now sets its sights on the $2 trillion club for 2024.

NVIDIA and META crashed the top six party this year. META is projected to hit one trillion market cap in 2024 thanks to a roughly 174% stock return in 2023. The only tech titan to outdo Meta was NVIDIA, with a market cap that closed 2022 in 12th place, but thanks to an absurd 226% year-to-date gain, now sits fifth and in firmly in club trillion. Even as sector peer Advanced Micro Devices (AMD) unveiled its AI chips to eat into NVIDIA’s massive market share of semiconductors, NVDA stock itself was unaffected, rising 1.4% this week.

The common thread here is that these companies are such tours de force that there’s really no such thing as ‘headwinds’ for the stocks. It doesn’t matter if earnings reports are lackluster, legal woes swirl, or a shiny new competitor emerges, the Big Six machine will chug along in the race to the top. But as bleak as that sounds, Big Tech’s outperformance does have a trickle-down effect – of the 50 biggest market cap gainers of 2023 seen below, half belong to the tech sector.

Image and article originally from www.schaeffersresearch.com. Read the original article here.