Fintel reports that on April 21, 2023, Keybanc maintained coverage of Talos Energy (NYSE:TALO) with a Overweight recommendation.

Analyst Price Forecast Suggests 80.94% Upside

As of April 6, 2023, the average one-year price target for Talos Energy is $25.30. The forecasts range from a low of $18.18 to a high of $42.00. The average price target represents an increase of 80.94% from its latest reported closing price of $13.98.

See our leaderboard of companies with the largest price target upside.

The projected annual revenue for Talos Energy is $2,073MM, an increase of 25.75%. The projected annual non-GAAP EPS is $5.64.

What are Other Shareholders Doing?

SEIAX – SIIT Multi-Asset Real Return Fund – holds 1K shares representing 0.00% ownership of the company. In it’s prior filing, the firm reported owning 3K shares, representing a decrease of 203.96%. The firm decreased its portfolio allocation in TALO by 68.94% over the last quarter.

Michelson Medical Research Foundation holds 140K shares representing 0.11% ownership of the company.

TIAA SEPARATE ACCOUNT VA 1 – Stock Index Account Teachers Personal Annuity Individual Deferred Variable Annuity holds 2K shares representing 0.00% ownership of the company. No change in the last quarter.

Zurcher Kantonalbank holds 9K shares representing 0.01% ownership of the company. In it’s prior filing, the firm reported owning 7K shares, representing an increase of 24.71%. The firm decreased its portfolio allocation in TALO by 99.86% over the last quarter.

Group One Trading holds 23K shares representing 0.02% ownership of the company. In it’s prior filing, the firm reported owning 9K shares, representing an increase of 58.16%. The firm increased its portfolio allocation in TALO by 220.52% over the last quarter.

What is the Fund Sentiment?

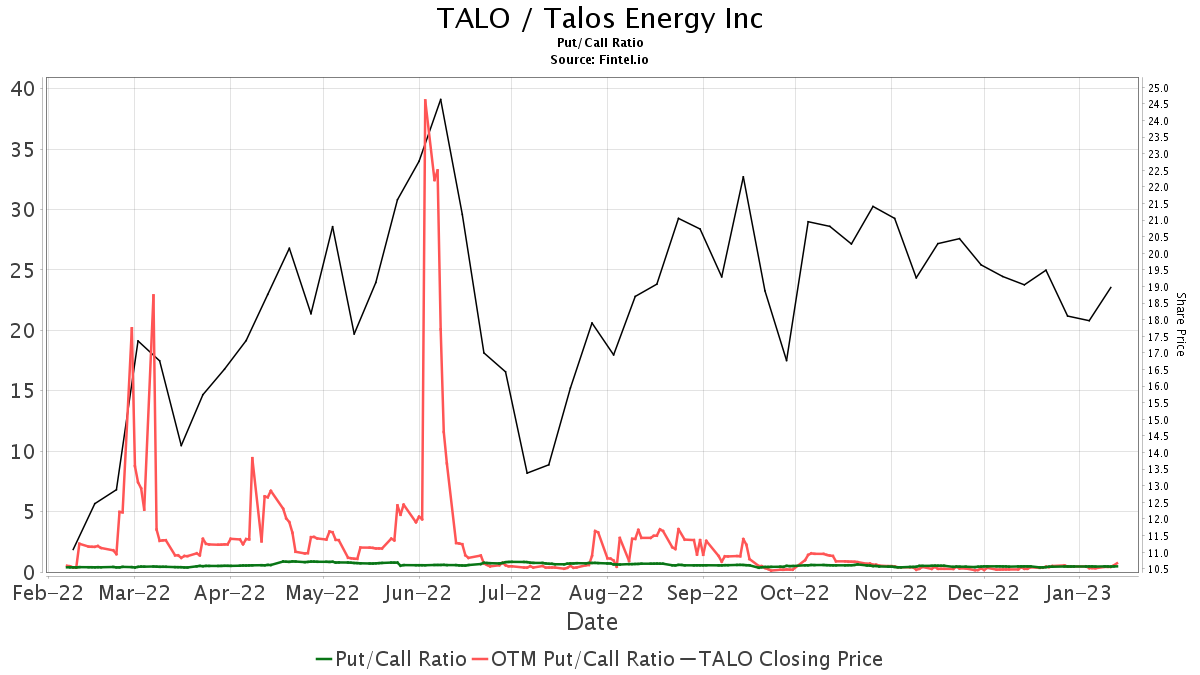

There are 517 funds or institutions reporting positions in Talos Energy. This is an increase of 9 owner(s) or 1.77% in the last quarter. Average portfolio weight of all funds dedicated to TALO is 0.20%, an increase of 3.47%. Total shares owned by institutions increased in the last three months by 4.25% to 94,828K shares.  The put/call ratio of TALO is 0.41, indicating a bullish outlook.

The put/call ratio of TALO is 0.41, indicating a bullish outlook.

Talos Energy Background Information

(This description is provided by the company.)

Talos Energy is a technically driven independent exploration and production company focused on safely and efficiently maximizing cash flows and long-term value through its operations, currently in the United States Gulf of Mexico and offshore Mexico. As one of the U.S. Gulf of Mexico’s largest public independent producers, Talos Energy leverages decades of geology, geophysics and offshore operations expertise towards the acquisition, exploration, exploitation and development of assets in key geological trends that are present in many offshore basins around the world. Its activities in offshore Mexico provide high impact exploration opportunities in an oil rich emerging basin.

See all Talos Energy regulatory filings.

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Image and article originally from www.nasdaq.com. Read the original article here.