A historically bullish trendline is flashing for the cereal stock

Household cereal name Kellogg Inc (NYSE:K) hasn’t been immune to the caprices of the the market. The stock has been falling from its more than five-year high of $76.99, hit on Aug. 19, with pressure emerging at the formerly supportive 10-day moving average. However, K is faring better than most, boasting a 12.2% year-to-date lead. What’s more, this pullback put the stock right within striking distance of a historically bullish trendline that could launch it back toward its aforementioned peak.

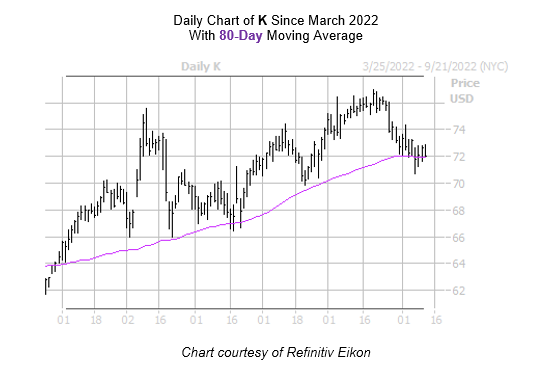

According to data compiled by Schaeffer’s Senior Quantitative Analyst Rocky White, Kellogg stock just came within one standard deviation of its 80-day moving average. The equity has seen four similar pullbacks in the last three years. One month after all four of these occurrences, Kellogg stock was higher, averaging a 1.4% pop during that time period. From its current perch, a similar move would put the stock back above the $73 level.

An unwinding of pessimism among options traders could create additional tailwinds. At the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), the stock sports a 50-day put/call volume ratio that stands higher than 90% of readings from the past year. This means long puts have rarely been more popular during this time period.

Short-term options traders have rarely been more put-biased as well. This is per the stock’s Schaeffer’s put/call open interest ratio (SOIR) of 0.82, which stands higher than 79% of annual readings.

It’s also worth noting that K could experience a short-term bounce soon, as its 14-day Relative Strength Index (RSI) sits at 38 — right on the cusp of “oversold” territory.

Considering all of this, now might be the ideal time to speculate on Kellogg stock’s next move with options. The security’s Schaeffer’s Volatility Index (SVI) of 20% sits higher than just 27% of readings from the past year. This means options traders have been pricing in relatively low volatility expectations at the moment.

Image and article originally from www.schaeffersresearch.com. Read the original article here.