ronstik/iStock via Getty Images

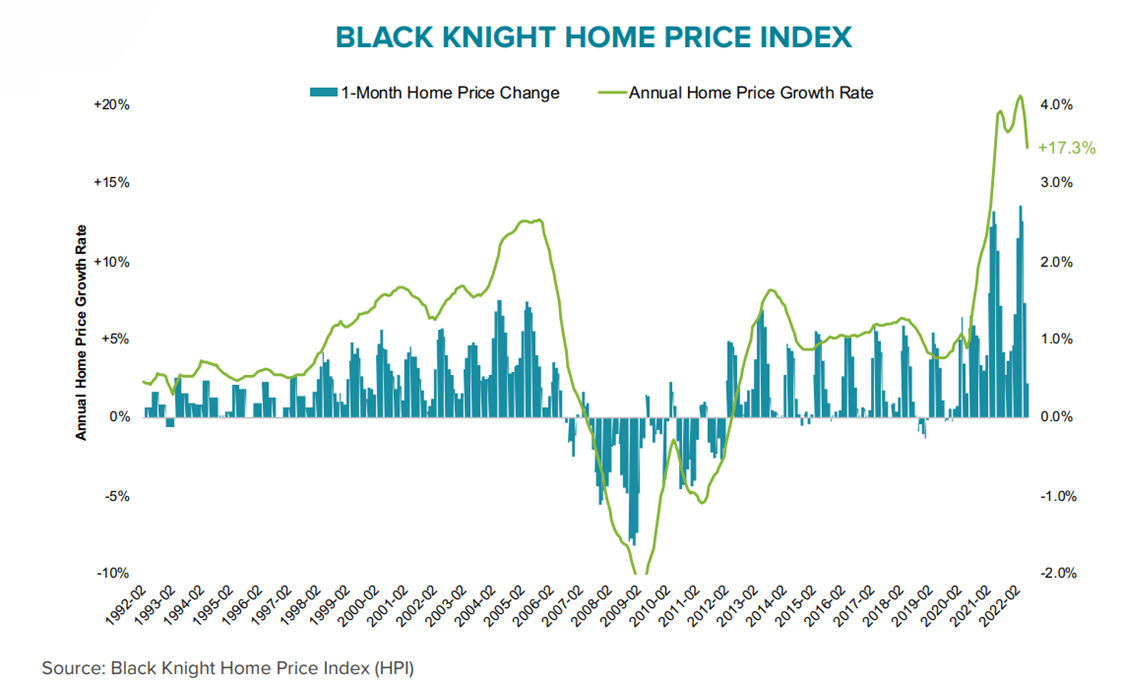

U.S. annual home price appreciation slowed in June to 17.3% in June from 19.3% in May, representing the biggest slowdown since at least the early 1970s, Black Knight said in its June Mortgage Monitor. That represents the third straight month of decelerating home price growth.

Before the June cool-down in home price growth, the largest single-month reduction in growth was 1.2 percentage points in the housing downturn of 2006.

The price growth is likely to cool even further. “While this was the sharpest cooling on record nationally, we’d need six more months of this kind of deceleration for price growth to return to long-run averages,” said Ben Graboske, president of Black Knight Data & Analytics. “Given it takes about five months for interest rate impacts to be fully reflected in traditional home price indexes we’re likely not yet seeing the full effect of recent rate spikes, with the potential for even stronger slowing in coming months.”

The mortgage report also shows that housing supply is increasing. Black Knight’s Collateral Analytics data showed seasonally adjusted 22% increase in the number of homes listed for sale over the past two months. Still, the market is at a 54% listing deficit compared with 2017-2019 levels, Graboske said.

“With a national shortage of more than 700,000 listings, it would take more than a year of such record increases for inventory levels to fully normalize,” he said.

A week ago, U.S. housing affordability poised to fall to lowest since GFC on soaring prices, rates, S&P Global Ratings said.

Image and article originally from seekingalpha.com. Read the original article here.