A VIX breakout could pour cold water on bulls’ recent rally

“…technical resistance at the late-May and early-June highs did exert itself. But even after technical resistance took hold and futures traders placed much higher odds on another 125-basis points of rate hikes in the next seven months, the SPX traded higher relative to the week prior’s close…The SPX did not push above short-term resistance, but seemingly negative news last week did not prevent a weekly close higher. As such, there wasn’t any reason to make any substantial moves if you took an aggressively bullish stance after the mid-July breakout above trendline resistance. I continue to think there is minimal upside to the 4,375 area for reasons discussed in prior commentaries.”

-Monday Morning Outlook, August 7, 2022

Per the excerpt above, the S&P 500 Index (SPX—4,280.15) failed to overtake its May and June highs two weeks ago, but still rallied as expectations surged for an even more hawkish Fed in the months ahead. In hindsight, such action amid expectations for a more hawkish Fed proved to be a major tell.

The events of two weeks ago preceded pleasant surprises last week on July inflation data released Wednesday and Thursday. While the SPX still advanced amid “bad news” in the week prior, the index surged through its May and June highs after a couple of days of “good news” on the inflation front. Moreover, it was the SPX’s first close above 4,262 since early May. The 4,262 level was the SPX’s close the eve before the Fed’s initial rate hike in the current cycle of increasing rates.

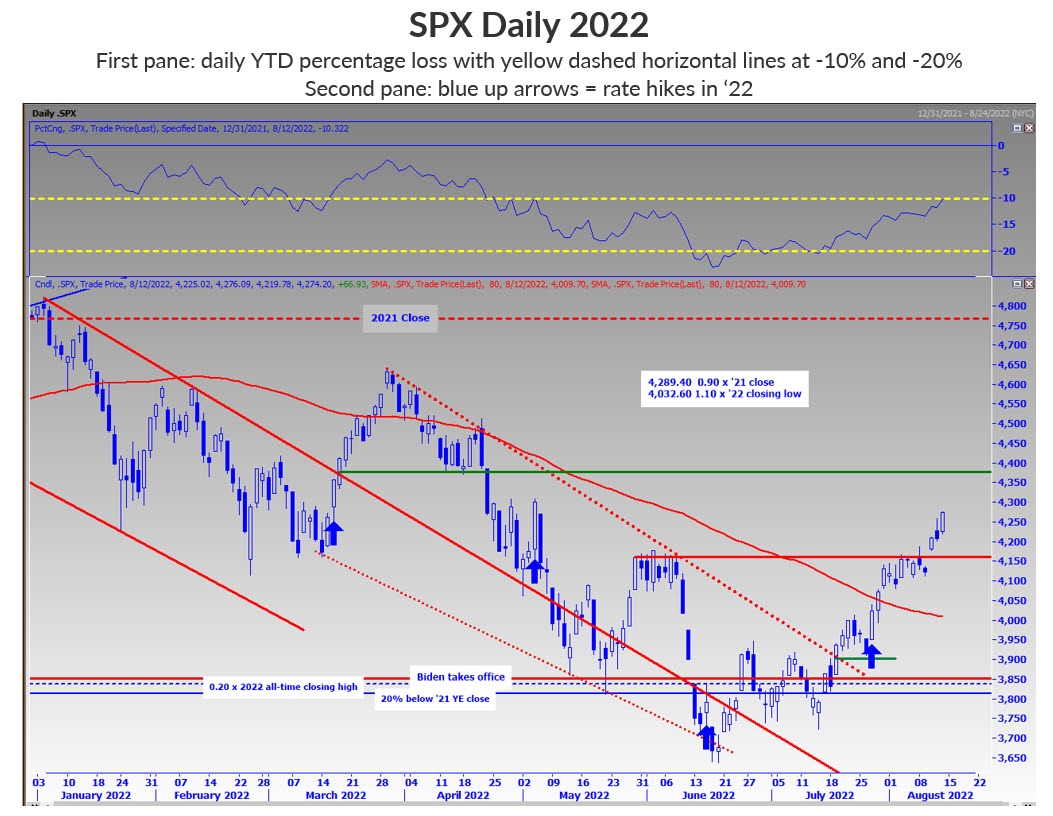

As always, when an index or equity rallies after a prolonged selloff, there are multiple potential resistance levels overhead. With that said, and per the chart below, the level that corresponds with the SPX’s round 10% below the 2021 close is at 4,289. In February-March, the index chopped around this area, and it acted as short-term resistance in early May prior to a steep selloff. Immediately above the round 4,300-century mark is 4,313, which is a round 10% below the SPX’s record closing high in January.

As extremes in negative sentiment continue to unwind amid technical breakouts, I continue to see resistance levels as hesitation points along the way to my first target of 4,375.

If you got aggressive on the long side following the mid-July breakout above trendline resistance, you could take a little money off the table if the SPX retreats below the May and June highs as a way of steadily reducing exposure amid weakness that could evolve into further weakness. I am not necessarily expecting this to happen, but it is a plan to play such a possibility.

The Nasdaq-100 Index (NDX—13,565.87) experienced another breakout above potential trendline resistance last week, just as the SPX did last month. As I said last week, I find this price action encouraging from a contrarian perspective on the heels of a Bloomberg BusinessWeek cover story in late May entitled, “The Great Tech Rout.”

If you are aggressively long this sector, you could define your “first level of risk” as last week’s breakout level above the trendline connecting lower highs since December at 13,280. Or, for this week, a close back below the trendline, which starts the week at 13,250 and ends the week at 13,160. A bigger level is 12,300, which is where a trendline connecting higher lows on the NDX is sitting, a break of which would lead to a likely retest of the lows. But this level is 10% below last week’s close, which is why I would consider taking some money off the table on a move below the 13,160 level. This is a level to focus on in the days ahead and can be adjusted later if necessary.

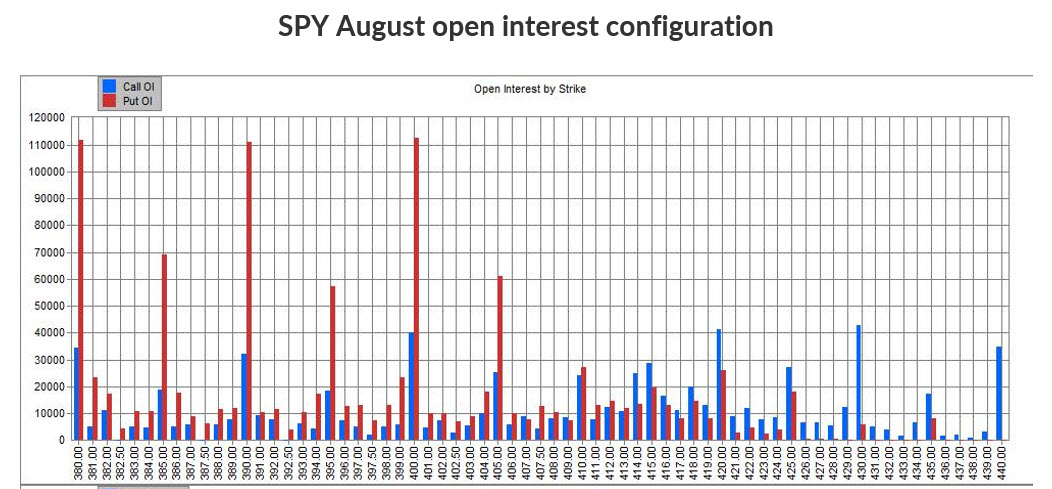

It is standard expiration week for August. In reviewing the SPDR S&P 500 ETF Trust (SPY – 427.10) open interest configuration, the 430-strike, which is equivalent to SPX 4,300, stands out. It is the first strike where call open interest is far above put open interest and could pose as a “call wall” this week. The good news is that: 1) this call wall is small and 2) it would take a SPY move below its 400 strike, or SPX 4,000, to put bulls in immediate danger of huge put open interest below the 400-strike acting like magnets, which occurred June expiration week.

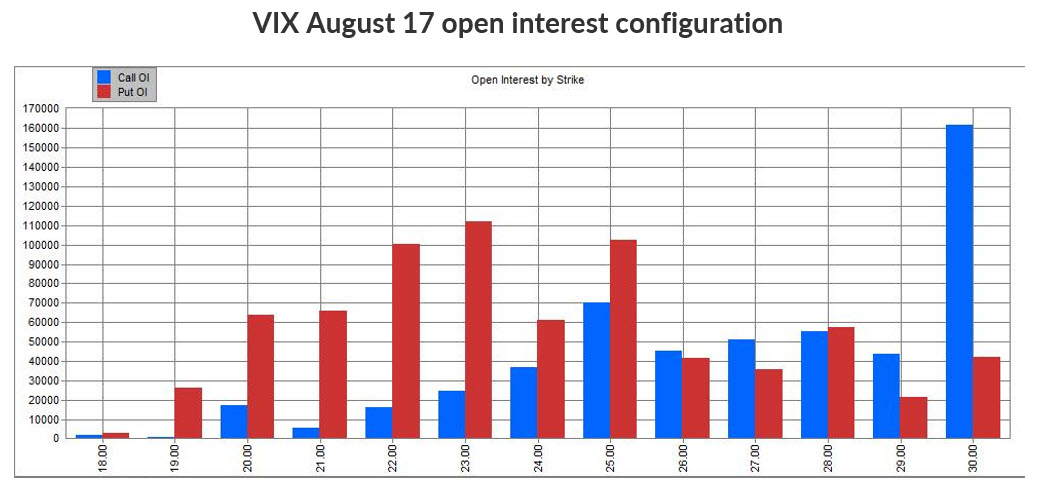

A reminder too that options on August Cboe Market Volatility Index futures (VXc1 – 21.15) expire Wednesday morning. With the contract close just above the 21-strike on Wednesday, amid a history of a plethora of both call and put open interest expiring worthless historically, an immediate risk to bulls is a VIX and VIX futures pop to a level that attempts to maximize the number of August option contracts that expire worthless. If such a scenario materializes, we would see the VIX in the 24-26 area Wednesday morning.

Todd Salamone is a Senior V.P. of Research at Schaeffer’s Investment Research

Continue Reading:

Image and article originally from www.schaeffersresearch.com. Read the original article here.