This bullish signal has never failed Peabody Energy stock

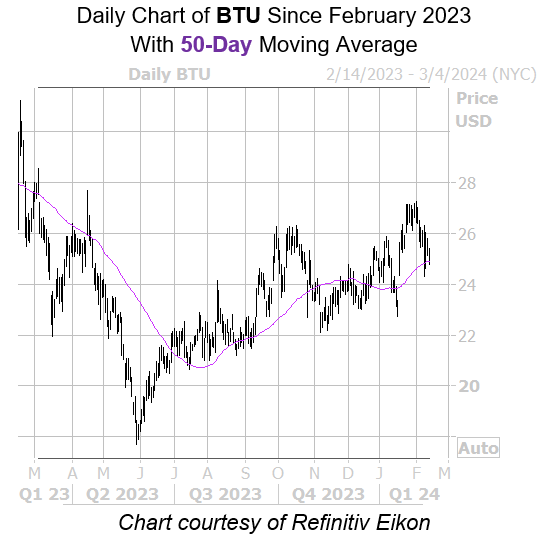

The equity moved higher one month later after each of those instances, with an average 5.4% gain. A comparable move from its current perch would place BTU just below $26.

A short squeeze could power up those gains to set Peabody Energy stock above that aforementioned ceiling. Short interest rose 22.2% in the most recent reporting period, and the 19.55 million shares sold short account for 15% of the equity’s available float.

Puts have been more popular than usual, suggesting a sentiment shift in the options pits could bode well for BTU, too. Over at the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), the security’s 10-day put/call volume ratio of 2.14 stands higher than 96% of readings from the past year.

Options are affordably priced at the moment, making now an excellent time to weigh in on Peabody Energy stock’s next moves. This is per its Schaeffer’s Volatility Index (SVI) of 34% that sits higher than 8% of annual readings, indicating traders are now pricing relatively low volatility expectations.

Image and article originally from www.schaeffersresearch.com. Read the original article here.