Fintel reports that on May 12, 2023, HC Wainwright & Co. reiterated coverage of Alpine Immune Sciences (NASDAQ:ALPN) with a Buy recommendation.

Analyst Price Forecast Suggests 96.66% Upside

As of May 11, 2023, the average one-year price target for Alpine Immune Sciences is 15.30. The forecasts range from a low of 11.11 to a high of $17.85. The average price target represents an increase of 96.66% from its latest reported closing price of 7.78.

See our leaderboard of companies with the largest price target upside.

The projected annual revenue for Alpine Immune Sciences is 48MM, an increase of 86.76%. The projected annual non-GAAP EPS is -1.42.

What is the Fund Sentiment?

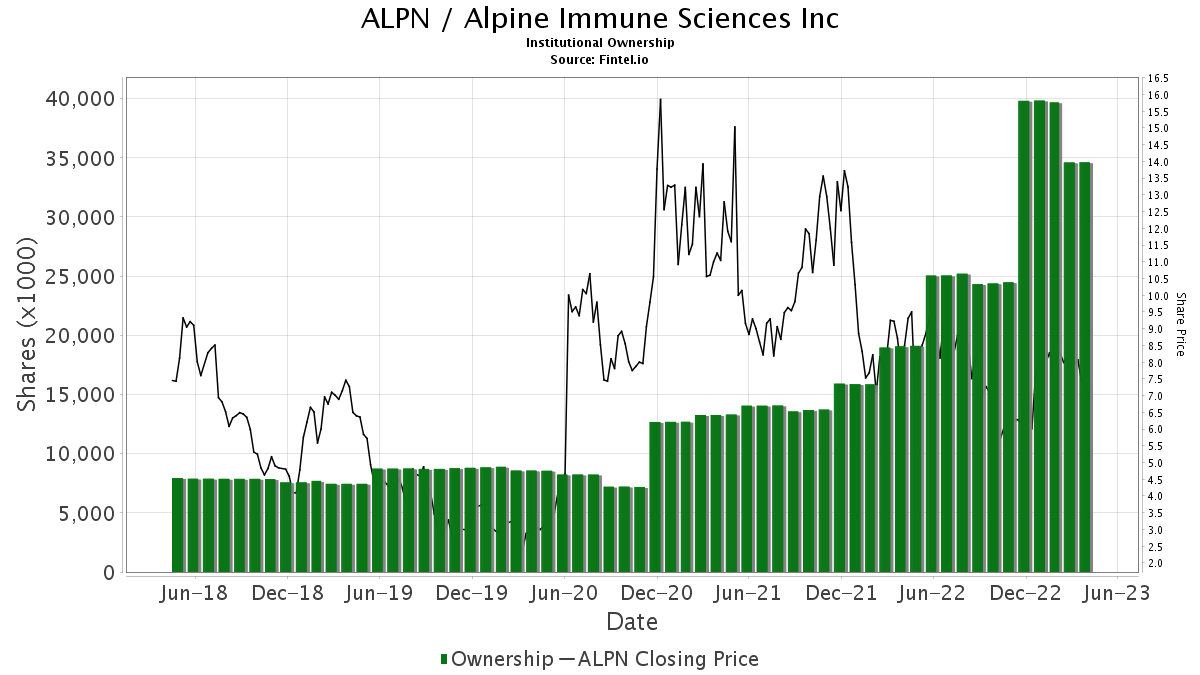

There are 167 funds or institutions reporting positions in Alpine Immune Sciences. This is a decrease of 4 owner(s) or 2.34% in the last quarter. Average portfolio weight of all funds dedicated to ALPN is 0.25%, a decrease of 5.25%. Total shares owned by institutions increased in the last three months by 3.34% to 34,467K shares. The put/call ratio of ALPN is 0.03, indicating a bullish outlook.

What are Other Shareholders Doing?

Ra Capital Management holds 4,397K shares representing 9.17% ownership of the company. In it’s prior filing, the firm reported owning 4,357K shares, representing an increase of 0.93%. The firm decreased its portfolio allocation in ALPN by 2.04% over the last quarter.

Orbimed Advisors holds 4,082K shares representing 8.51% ownership of the company. No change in the last quarter.

Great Point Partners holds 3,638K shares representing 7.58% ownership of the company. In it’s prior filing, the firm reported owning 3,449K shares, representing an increase of 5.20%. The firm decreased its portfolio allocation in ALPN by 12.34% over the last quarter.

Lynx1 Capital Management holds 3,126K shares representing 6.52% ownership of the company. In it’s prior filing, the firm reported owning 3,056K shares, representing an increase of 2.23%. The firm increased its portfolio allocation in ALPN by 0.11% over the last quarter.

Frazier Life Sciences Management holds 2,986K shares representing 6.22% ownership of the company. No change in the last quarter.

Alpine Immune Sciences Background Information

(This description is provided by the company.)

Alpine Immune Sciences, Inc. is committed to leading a new wave of immune therapeutics. With world-class research and development capabilities, a highly productive scientific platform, and a proven management team, Alpine is seeking to create first- or best-in-class multifunctional immunotherapies via unique protein engineering technologies to improve patients’ lives. Alpine has entered into strategic collaborations with leading global biopharmaceutical companies and has a diverse pipeline of clinical and preclinical candidates in development.

See all Alpine Immune Sciences regulatory filings.

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Image and article originally from www.nasdaq.com. Read the original article here.