Fifth Third Bancorp will report earnings ahead of the open tomorrow

Fifth Third Bancorp (NASDAQ:FITB) is one of the many bank giants reporting earnings this week. The Cincinnati-based firm’s fourth-quarter earnings report is due out before the open tomorrow, Jan. 19, in which analysts expect profits of $1.00 per share. FITB is slipping ahead of the results, down 3.4% at $32.95 at last check today.

A look at its post-earnings history shows Fifth Third stock finishing only one of the last eight next-day sessions higher. Over these past two years, FITB has averaged a 2.9% swing the following day, regardless of direction. This time around, the options pits are pricing in a 5.3% move.

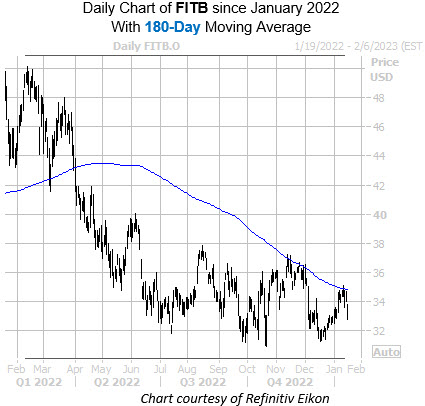

On the charts, the security’s descending 180-day moving average has pressured the stock lower over the past couple months. Year-over-year, the stock is down 33.5%.

Now could be a good time to weigh in on the security’s next move with options. The stock is seeing attractively priced premiums at the moment, per FITB’s Schaeffer’s Volatility Index (SVI) of 31%, which sits in the 14th percentile of its annual range. It’s also worth pointing out that the equity ranks low on the Schaeffer’s Volatility Scorecard (SVS), with a score of just nine out of 100. In other words, the security has consistently realized lower volatility than its options have priced in, making the stock a potential premium-selling candidate.

Image and article originally from www.schaeffersresearch.com. Read the original article here.