Fintel reports that on July 5, 2023, Evercore ISI Group maintained coverage of Trupanion (NASDAQ:TRUP) with a Outperform recommendation.

Analyst Price Forecast Suggests 80.03% Upside

As of June 1, 2023, the average one-year price target for Trupanion is 39.65. The forecasts range from a low of 25.25 to a high of $53.55. The average price target represents an increase of 80.03% from its latest reported closing price of 22.02.

See our leaderboard of companies with the largest price target upside.

The projected annual revenue for Trupanion is 1,123MM, an increase of 17.53%. The projected annual non-GAAP EPS is -0.92.

What is the Fund Sentiment?

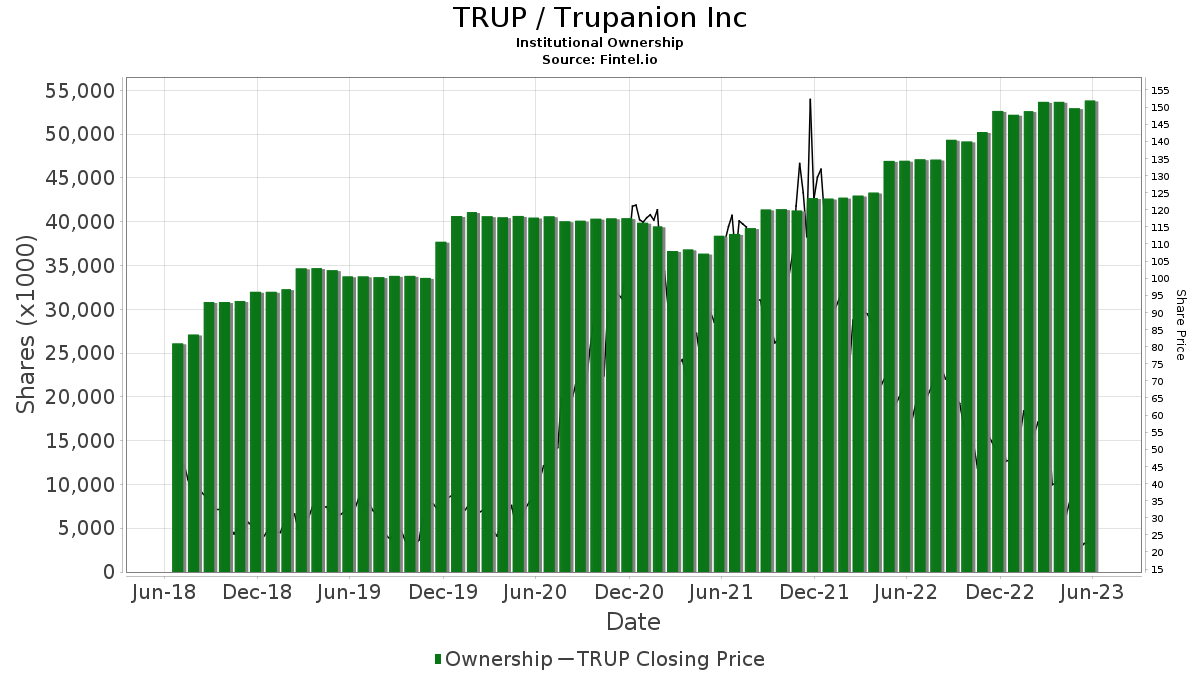

There are 453 funds or institutions reporting positions in Trupanion. This is a decrease of 11 owner(s) or 2.37% in the last quarter. Average portfolio weight of all funds dedicated to TRUP is 0.39%, an increase of 77.26%. Total shares owned by institutions increased in the last three months by 0.28% to 53,822K shares. The put/call ratio of TRUP is 3.94, indicating a bearish outlook.

What are Other Shareholders Doing?

Capital World Investors holds 4,020K shares representing 9.75% ownership of the company. In it’s prior filing, the firm reported owning 4,019K shares, representing an increase of 0.04%. The firm decreased its portfolio allocation in TRUP by 12.47% over the last quarter.

Nine Ten Capital Management holds 3,640K shares representing 8.83% ownership of the company. In it’s prior filing, the firm reported owning 3,744K shares, representing a decrease of 2.85%. The firm decreased its portfolio allocation in TRUP by 15.89% over the last quarter.

Aflac holds 3,636K shares representing 8.82% ownership of the company. No change in the last quarter.

SMCWX – SMALLCAP WORLD FUND INC holds 2,970K shares representing 7.20% ownership of the company. In it’s prior filing, the firm reported owning 3,271K shares, representing a decrease of 10.12%. The firm decreased its portfolio allocation in TRUP by 23.44% over the last quarter.

Flossbach Von Storch holds 2,880K shares representing 6.99% ownership of the company. No change in the last quarter.

Trupanion Background Information

(This description is provided by the company.)

Trupanion is a leader in medical insurance for cats and dogs throughout the United States and Canada. For over two decades, Trupanion has given pet owners peace of mind so they can focus on their pet’s recovery, not financial stress. Trupanion is committed to providing pet owners with the highest value in pet medical insurance with unlimited payouts for the life of their pets. Trupanion is listed on NASDAQ under the symbol ‘TRUP’. The company was founded in 2000 and is headquartered in Seattle, WA. Trupanion policies are issued, in the United States, by its wholly-owned insurance entity American Pet Insurance Company and, in Canada, by Omega General Insurance Company.

Additional reading:

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Image and article originally from www.nasdaq.com. Read the original article here.