Call traders have been interested in TSLA for quite some time

Tesla Inc (NASDAQ:TSLA) is down 6.5% at $194.01 at last check, despite the electric vehicle (EV) giant announcing deliveries hit a quarterly record. Quarter-to-quarter sales growth failed to impress, even as the company dramatically lowered its prices amid fierce competition and a tough economic backdrop.

What’s more, Tesla produced 18,000 more vehicles than it delivered, fueling additional concerns over price and demand. Still, TD Cowen hiked its price objective to $170 from $140.

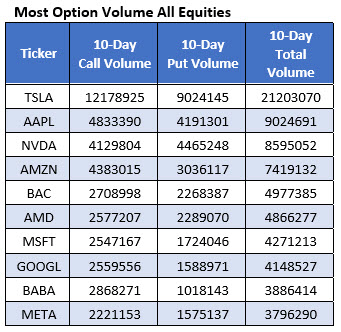

The security often appears on Schaeffer’s Senior Quantitative Analyst Rocky White’s list of S&P 400 Mid Cap Index (IDX) stocks that have attracted the highest weekly options volume during the last 10 days. TSLA led the pack over the past two weeks, though, with 12,178,925 calls and 9,024,145 puts traded. The most popular contract was the weekly 3/31 200-strike call.

This penchant for bullish bets dates back even farther, per the security’s 50-day call/put volume ratio of 1.38 over at the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), which stands higher than all readings from the past year.

It’s also worth noting the stock’s Schaeffer’s Volatility Scorecard (SVS) sits at 93 out of 100, indicating it has exceeded option traders’ volatility expectations in the past year.

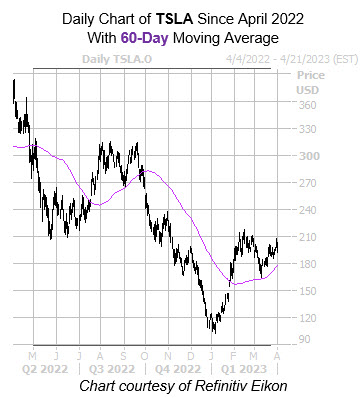

Resistance at the $210 level has been keeping the security in check since mid-February, though support remains at its 60-day moving average. Tesla stock is up 57.7% year-to-date, but over the past 12 months it has shed 46.3%.

Image and article originally from www.schaeffersresearch.com. Read the original article here.