Commodities are at an inflection point

Subscribers to Chart of the Week received this commentary on Sunday, December 3.

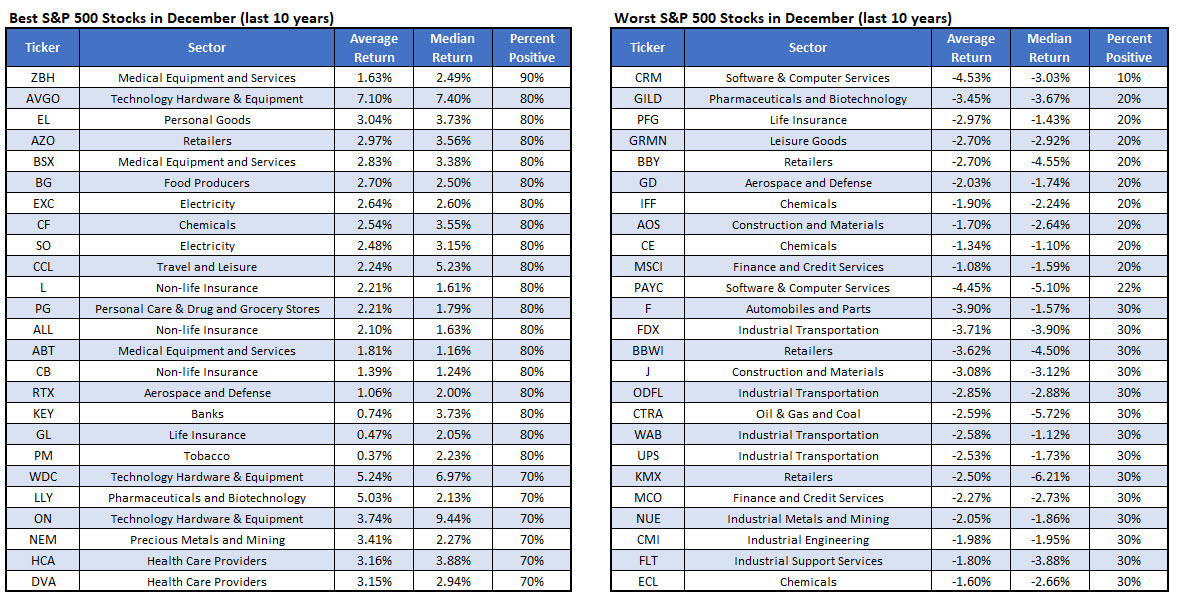

As we head into the last month of 2023, our team has done our monthly due diligence, taking a closer look at the 25 best and worst stocks to own in December, historically, thanks to data from Schaeffer’s Senior Quantitative Analyst Rocky White. Some of notable names at the top of the “Best of” list include chip giant Broadcom (AVGO), retail stalwarts Estee Lauder (EL) and AutoZone (AZO), as well as medical equipment stock Zimmer Biomet (ZBH), which claims an impressive 90% win rate over the past 10 years.

On the flip side, the list of 25 worst stocks to own in December includes several outperformers of 2023, such as Salesforce (CRM), GPS giant Garmin (GRMN), and shipping name FedEx (FDX). All three of these stocks boast year-to-date gains of 97%, 33%, and 52%, respectively, so it will be interesting to weigh historical returns vs. recent performance. With this in mind, we’re going to take a dive into a corner of Wall Street that’s analyzed less frequently for its historic monthly turnout; exchange traded funds (ETFs).

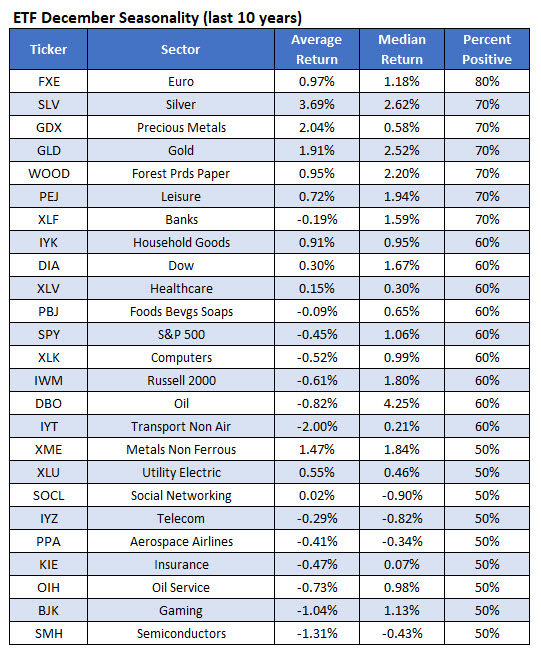

Looking at the table below, it’s worth noting right off the bat is the lower threshold of positive performance ETFs have seen, historically, in December. Only a handful have managed to record a positive performance at least 70% of the time, and even some of the consistent performers like the Financial Select Sector SPDR Fund (XLF) average a 0.2% loss for the month.

Commodities are at an inflection point. Oil ETFs Invesco DB Oil Fund (DBO) and VanEck Oil Services ETF (OIH) are both hanging onto positive year-to-date territory following a lackluster year on the charts. Both average a 0.8% and 0.7% loss for the month, with respective positive rates of 60% and 50%. Safe-haven asset gold, on the other hand, is a different story; SPDR Gold Shares (GLD) historically outperform in the bookend month to the year, with a respectable 2% average return, finishing higher 70% of the time.

Enjoying its spot at the top of the table, however, is Invesco CurrencyShares Euro Trust (FXE), which historically carries a win rate of 80% in the last decade to go with a respectable average return of 1%. This type of December performance would bode well for FXE, as the shares enter December at its breakeven year-to-date level and, as of this writing, are headed toward a third-straight daily drop. As declining euro zone inflation data continues to topple estimates and bond yields cool off, it could set up quite the Santa Claus rally for the Euro heading into the new year.

Image and article originally from www.schaeffersresearch.com. Read the original article here.