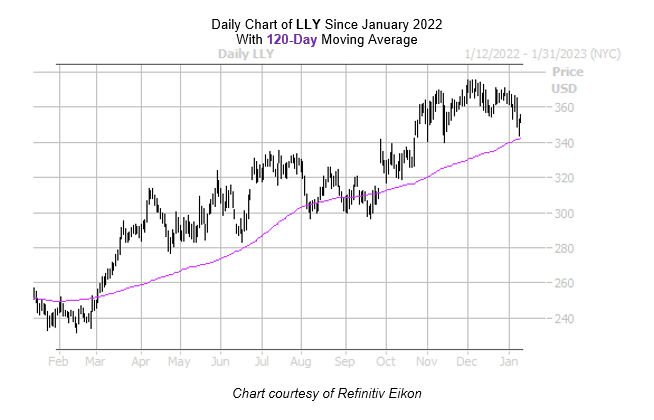

LLY’s 120-day moving average has been bullish for the equity in the past

According to BMO, near-term hurdles such as competition for key drugs and patent expiries won’t derail the long-term revenue and earnings growth of Eli Lilly And Co (NYSE:LLY). While the drugmaker forecasts annual profit and revenue below estimates in November, the brokerage noted the company’s diabetes drug Mounjaro is tracking above expectations. Even better for Eli Lilly stock, it’s shares just pulled back to a historically bullish trendline on the charts.

More specifically, Eli Lilly stock is trading near its 120-day moving average, which has acted as a springboard for the equity in the past. According to data from Schaeffer’s Senior Quantitative Analyst Rocky White, eight similar signals have occurred during the past three years. One month later, LLY enjoyed a 5.1% gain, 75% of the time. Last seen up 0.8% at $355.61, a move of similar magnitude from its current perch would put the equity within a chip-shot of its Dec. 5 all-time high of $375.25.

On a year-over-year basis, Eli Lilly stock stands 35.5% higher. Meanwhile, on a closing basis, the $375 level acted as a ceiling during the security’s trading at its aforementioned peak.

It doesn’t look like the brokerage bunch needed much encouragement considering 14 or 16 in coverage rate LLY a “buy” or better; however, at least two recommend a tepid “hold,” leaving a little room for an unwinding of pessimism. Further, the 12-month consensus target price of $389.52 is a 9.6% premium to the stock’s current perch.

Options traders have been slightly more bearish than unusual, so a shift in sentiment in the options pits could put additional wind at the equity’s back. Eli Lilly Stock’s Schaeffer’ put/call open interest ratio (SOIR) of 1.52 stands higher than 93% of annual readings, and indicates short-term traders have rarely been more put-biased. What’s more, the stock’s 50-day put/call volume ratio stands higher than 72% of annual readings at the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX).

Now looks like a great opportunity to take advantage of Eli Lilly stock’s next move with options. The security’s Schaeffer’s Volatility Index (SVI) of 25% sits in the relatively low 14th percentile of its annual range. This means the stock is currently sporting attractively priced premiums.

Image and article originally from www.schaeffersresearch.com. Read the original article here.