The security is flashing a historically bearish signal

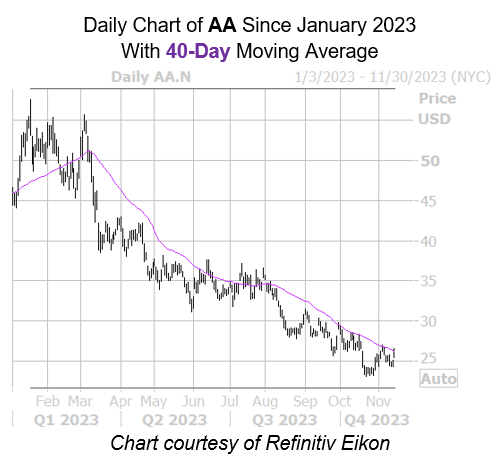

Alcoa Corp (NYSE:AA) stock is enjoying tailwinds this afternoon, last seen up 6.6% at $26.22, though a specific catalyst for this positive price action remains unclear. AA could soon backpedal, though, as it is now flashing a historically bearish signal. This potential plunge could also place the security within a chip-shot of its Oct. 23, two-year low of $23.07, and extend its already steep 42.6% year-to-date deficit, with additional pressure stemming from its 40-day moving average.

This is currently the case with the stock’s SVI of 47%, which sits in the 12th percentile of its annual range. Shares were lower one month after that signal, averaging an 8.2% dip. From its current trading levels, a move of similar magnitude would put AA back around $24.

At the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), AA sports a 50-day put/call volume ratio of 3.45 that sits higher than 93% of annual readings. An unwinding of this optimism could weigh on the shares.

Image and article originally from www.schaeffersresearch.com. Read the original article here.