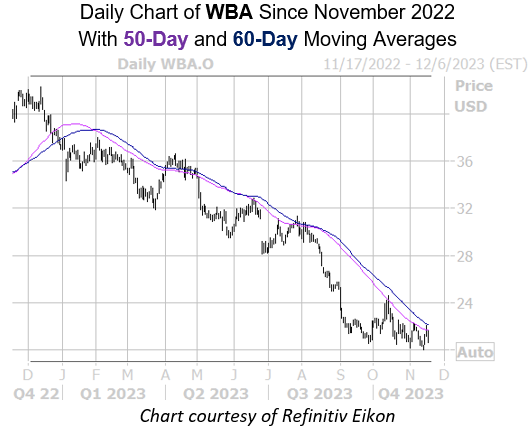

WBA has come into contact with two historically bearish trendlines

Blue-chip pharmaceutical stock Walgreens Boots Alliance (NASDAQ:WBA) is underperforming on the charts, recently hitting a Nov. 13 record low of $20.00. However, it may worth waiting to buy in the dip.

Though the stock bounced off its aforementioned lows, the $22 level, which kept a ceiling on gains for the last month, already rejected the short-lived rally. Today, Walgreens stock is down 4.1% at $20.67 at last glance, amid news that the company will close its stores for the Thanksgiving holiday. Plus, the shares are now within striking distance of two historically bearish trendlines.

More specifically, WBA is within one standard deviation of its 50- and 60-day moving averages, both of which were bearish for the stock in the past. The stock brushed its 60-day trendline six times in the past three years, after which it was lower one month later 100% of the time, averaging a 7.4% loss. It’s 50-day moving average saw seven similar signals, after which WBA was lower one month later 86% of the time, averaging a 3.7% loss.

An unwinding of optimism in the options pits could provide headwinds as well. At the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), Walgreens stock’s 10-day call/put volume ratio of 5.17 ranks higher than 82% of readings from the past year, indicating a strong penchant for calls of late.

Image and article originally from www.schaeffersresearch.com. Read the original article here.