DIS has pulled back to a historically bearish trendline on the charts

Walt Disney Co (NYSE:DIS) is in the news today after announcing a second round of job cuts will eliminate “several thousand” jobs from today until Thursday. Wells Fargo also chimed in with a bull note, raising its price target to $147 from $141.

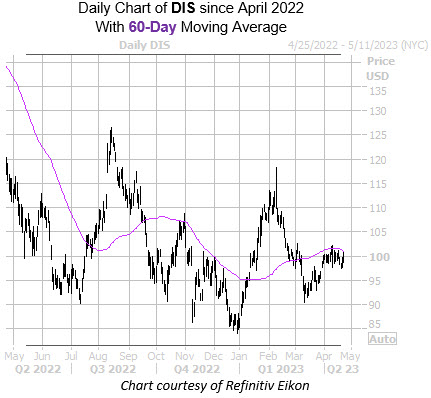

Walt Disney stock, like the majority of Dow members today, is flat despite the news, down 0.2% at $99.35 at last glance. There is reason to believe the shares could soon move lower, however, as DIS has happened upon a trendline with historically bearish implications.

The stock has come within one standard deviation of its 60-day moving average for the sixth time in the past three years. According to Schaeffer’s Senior Quantitative Analyst Rocky White, DIS was negative one month later 60% of the time, averaging a 5.7% loss. A similar move would place the equity below the $94 level for the first time since mid-March.

Now looks like a good time to weigh in with options. The stock is seeing attractively priced premiums at the moment, per Walt Disney stock’s Schaeffer’s Volatility Index (SVI) of 33%, which sits in the low 11th percentile of its annual range. Furthermore, the security’s Schaeffer’s Volatility Scorecard (SVS) sits at a 97 out of 100, meaning DIS has exceeded option traders’ volatility expectations during the past year.

Image and article originally from www.schaeffersresearch.com. Read the original article here.