Quantifying general bearish outside days, as well as bearish outside days amid highs

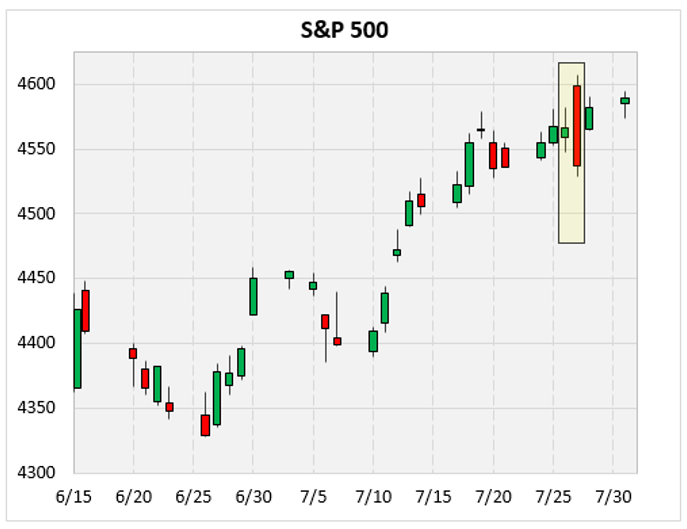

Last Thursday was an alarming day for traders who watch candlestick patterns. It was a bearish outside day, which means the session high was above the previous day’s high, while the low was lower than the previous day’s low. Also, the body of the candle was larger than the prior day. The bearish outside day is highlighted in the chart below. Outside days are considered by some a trend reversal signal or a shift in market sentiment. A bearish outside day on the same day the S&P 500 Index (SPX) hits a 52-week high seems especially significant.

Last October, we saw the opposite scenario. That was a bullish outside day at a 52-week low. I wrote about it at the time. The numbers did show, with limited data points, a tendency for the market to reverse soon after those occurrences. Additionally, that bullish outside day did mark the exact low since then. This week, I’ll look at how the S&P 500 performed in the past after these outside days. I’ll quantify the returns generally then specifically when bearish outside days occur at highs. I want to see if the data supports the narrative that we’ve increased the potential for a change in the trend.

Quantifying General Bearish Outside Days

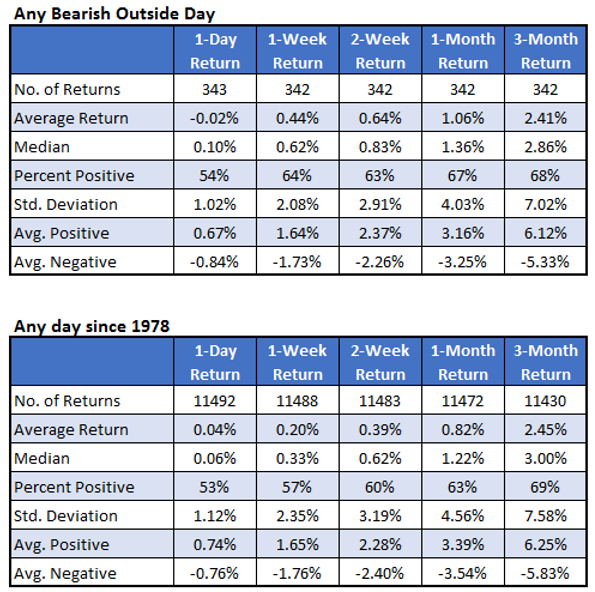

We have high/low data on the S&P 500 going back to 1978. Since then, there have been 343 bearish outside days. The table below summarizes the returns of the index for various time frames following these days. The second table shows anytime returns for the index for comparison.

The day after a bearish outside day has been bearish, with the S&P 500 averaging a slight loss the next day. The percentage of positive returns is little changed with 54% of returns positive after a bearish outside day compared to 53% usually. The negative average return is due to the limited upside on positive days and higher than normal downside on negative days (looking at the Avg. Positive and Avg. Negative rows). The bearishness, however, only lasts that one day.

After that first day, the one-week return to one-month returns are bullish, showing a higher than normal average return and percent positive. The three-month returns have been close to typical three-month returns.

Bearish Outside Days at 52-Week Highs

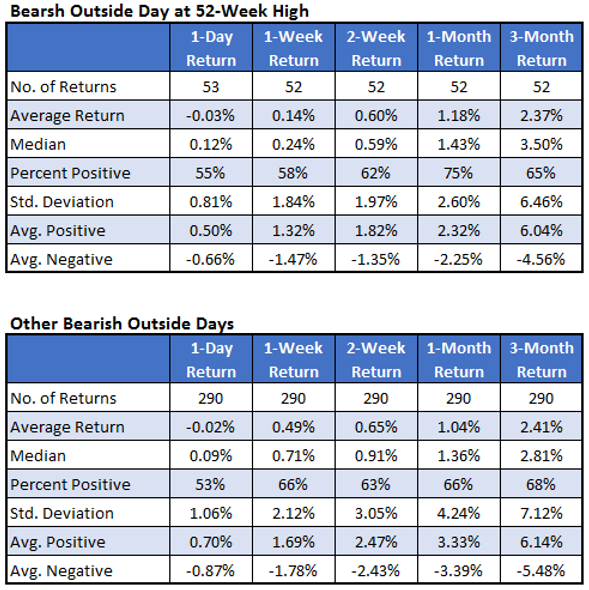

A factor that makes this bearish outside day significant is that it happened on the same day the S&P 500 hit a 52-week high. Recall, outside days are branded as being a trend reversal indicator. The table below summarizes the S&P 500 returns only after those bearish outside days that happened on the same day the index reached a 52-week high. The recent signal was the 53rd time we’ve seen it. The second table summarizes the returns for the other bearish outside days. Looking at the average return, there was some slight bearishness in the one-day and one-week returns. After that, there’s hardly any difference between whether the bearish outside day happens at a market high or not.

Bearish outside days have a reputation for predicting a trend reversal, but the numbers I looked at here do not support that.

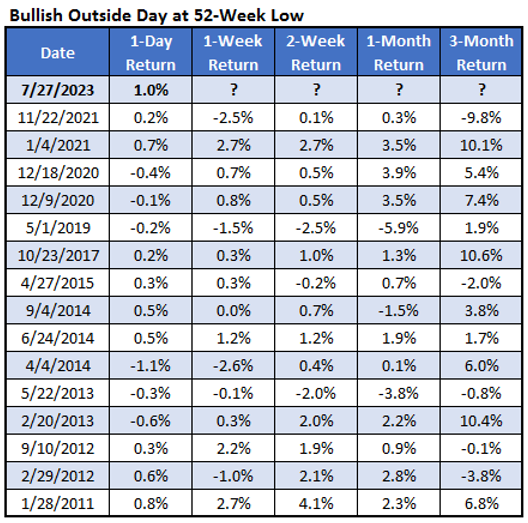

For those curious, this last table shows all the times since 2010 the S&P 500 experienced a bearish outside day at a 52-week high. The last time was late 2021 and the index lost about 10% over the next three months. The one prior was from early 2021, and the index gained about 10% in the next three months.

Image and article originally from www.schaeffersresearch.com. Read the original article here.