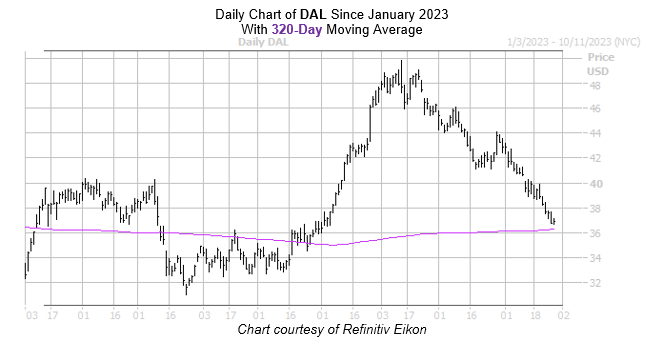

The 320-day moving average has pushed DAL higher in the past

The shares of Delta Air Lines, Inc. (NYSE:DAL) were last seen up 0.2% at $36.83. The security began trending lower after touching a more than two-year high in early July. A 22.5% haircut this quarter has helped cut its year-to-date lead down to 12.2%, but a historically bullish signal may be giving DAL an all-clear for takeoff.

Delta Air Line’s just came within one standard deviation of its long-term 320-day moving average, after trading well above the layer since May. Per data from Schaeffer’s Senior Quantitative Analyst Rocky White, four similar signal were observed in the last three years. After three of these occurrences, the stock was higher, averaging a one-month pop of 6.9%. A similar move from its current perch would put DAL above the $39 mark.

A shift in the options pits could create additional tailwinds for DAL. At the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), the stock sports a 50-day put/call volume ratio that is higher than 96% of readings from the past 12 months. In other words, long puts are being picked up at a quicker-than-usual clip.

Now looks like a good time to weigh in on the security’s next move with options. The stock is seeing attractively priced premiums, per its Schaeffer’s Volatility Index (SVI) of 41%, which sits in the slightly low 36th percentile of its annual range. Furthermore, the security’s Schaeffer’s Volatility Scorecard (SVS) sits at a relatively high 84 out of 100, meaning Delta Airlines stock exceeded option traders’ volatility expectations during the past year.

Image and article originally from www.schaeffersresearch.com. Read the original article here.