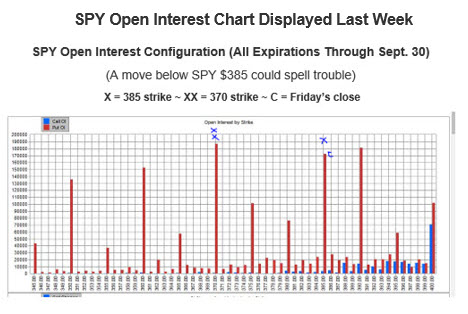

Put open interest at several SPY strikes below 385 was (and remain) heavy

“…with standard September options now expired, delta-hedge selling remains a risk. With September being the end of the quarter and the Federal Open Market Committee (FOMC) scheduled to meet this Tuesday and Wednesday, put open interest on SPY daily, weekly, and quarterly expiration options cannot be ignored. There appears to be a significant amount of hedging and/or speculation to guard against or profit from an unwelcome FOMC outcome and/or any other negative news into quarter-end.”

– Monday Morning Outlook, Sept. 19, 2022

In last week’s commentary, I cautioned that stocks stiff faced delta-hedging risk, whereby sellers of portfolio insurance, or put options on the index and exchange-traded fund (ETF) options, are forced to sell more and more S&P futures to remain hedged. This is, as big put open strikes below the market come into play.

Specifically, as denoted in the graph immediately below that I copied and pasted from that commentary, the SPY had closed just above the put-heavy SPDR S&P 500 ETF Trust’s (SPY — 367.95) 385 strike, where there was huge put open interest. As I noted above that chart, a move below that level would put equities at more risk of delta-hedge selling, as put open interest at several strikes below 385 was (and remains) heavy combining all SPY expirations through Sept. 30.

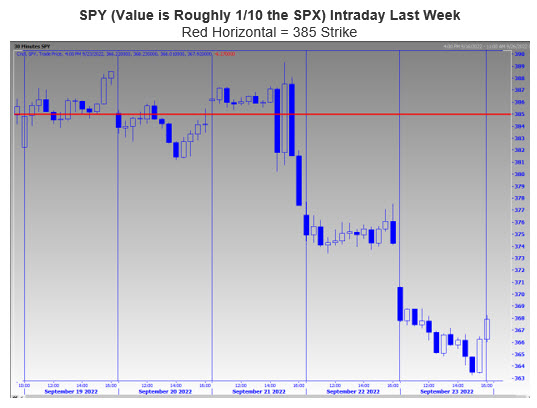

As you can see on SPY intraday chart below, when the SPY broke back below the 385 strike late in the day on Sept. 21, which was after the Federal Open Market Committee (FOMC) raised the fed funds rate another 75 basis points (as expected) and updated (and significantly raised above expectations) projections for the fed funds rate for next year. After, Chairman Jerome Powell gave his post-FOMC briefing, which was essentially a repeat of his Aug. 26 Jackson Hole, Wyoming “snuff out inflation at all costs” speech. This left the bottom to fall out once the 385 strike was breached again.

It was a snowball effect, with selling begetting more selling as major put open interest strike were approached. As I mentioned in previous commentaries, when an index or exchange-traded fund is trading just above multiple put-heavy strikes and a catalyst (“known,” or “unknown”) surfaces, risk of delta-hedge selling increases. By Friday, the SPY was trading down to $362.29 at its low.

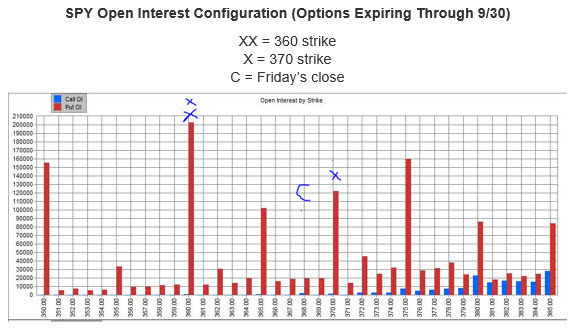

In commentary last week, I said potential for delta-hedge selling down to $SPY 330 strike before month end. Actually, potential to 350 strike, but 360 strike more likely since smaller “magnets” between 350 & 360 strikes, per graph below. pic.twitter.com/Bg23imCBNE

— Todd Salamone (@toddsalamone) September 23, 2022

Per my observation on Twitter on Friday morning, delta-hedge selling risk remains. If the SPY declines back below the 365 strike, it would put bulls at risk of a move down to the 360 strike, or below the June low, which could spark technical selling in addition to option-related selling. Also, be wary of rallies into big put open interest strikes, such as the 370-strike in the days ahead. Often, rallies back up to big put open interest strikes represent potential resistance.

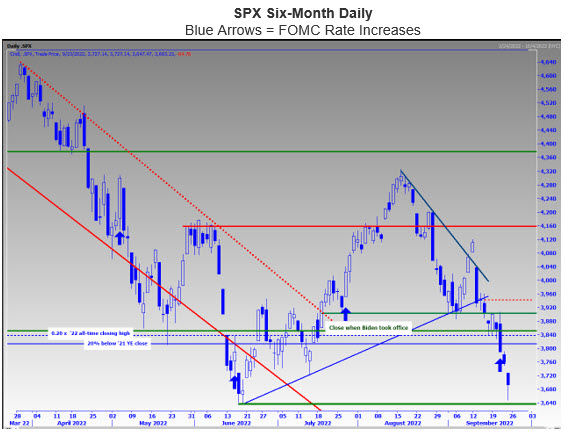

“When option-related buying or selling occurs around expiration weeks, technical analysis sometimes goes out the window for a short period. That said, the SPX did pullback to and rally from potential support levels we have discussed in the past. For example, SPX 3,581 is the SPX’s close when U.S. President Joe Biden took office. Just below that is 3,837, a level that corresponds with 20% below the SPX’s all-time closing high. And below that is 3,812, or a round 20% below the SPX’s 2021 close.”

– Monday Morning Outlook, Sept. 19, 2022

Per the excerpt above, if indeed last week’s selling was related to options open interest as described above, it isn’t unusual for technical support levels to be violated, at least temporarily. And so it was, and like June expiration, the S&P 500 Index (SPX — 3,693.23) dipped below potential levels of support that held two weeks ago. The index did find support from the area of its June lows during Friday’s trading, but after what occurred the prior week, one can reasonably question how robust this support level is in the days ahead. That is, with big put open interest magnets that are set to expire this week on the SPY (which moves in tandem with the SPX) just below current levels.

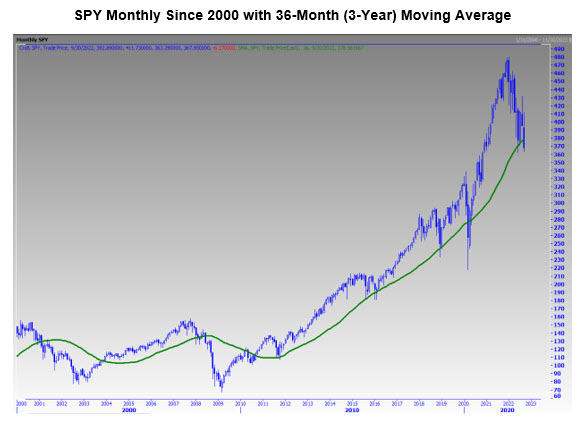

Moreover, at Thursday’s close, the SPY moved below $378.73, site of its 36-month, or three-year, moving average. This long-term moving average, per previous commentaries, has marked multiple lows going back many years. We tend to emphasize the monthly close, but with delta-hedge selling a risk through month end, there is increasing likelihood, absent a catalyst that inspires risk-taking in the week ahead, that the SPY closes below this moving average at month end.

If indeed delta-hedge selling has been at work like I think, and if past is prologue, equities will stabilize immediately once the expiration-related selling we are observing comes to pass. As such, the start of a move back above the SPY’s 36-month moving average should occur in early October. If equities don’t begin to show “life” after September quarterly expiration, buyer beware that significant pain has followed monthly closes below the SPY’s 36-month moving average (March 2000, June 2008 are examples).

Todd Salamone is a Senior V.P. of Research at Schaeffer’s Investment Research

Continue Reading:

Image and article originally from www.schaeffersresearch.com. Read the original article here.