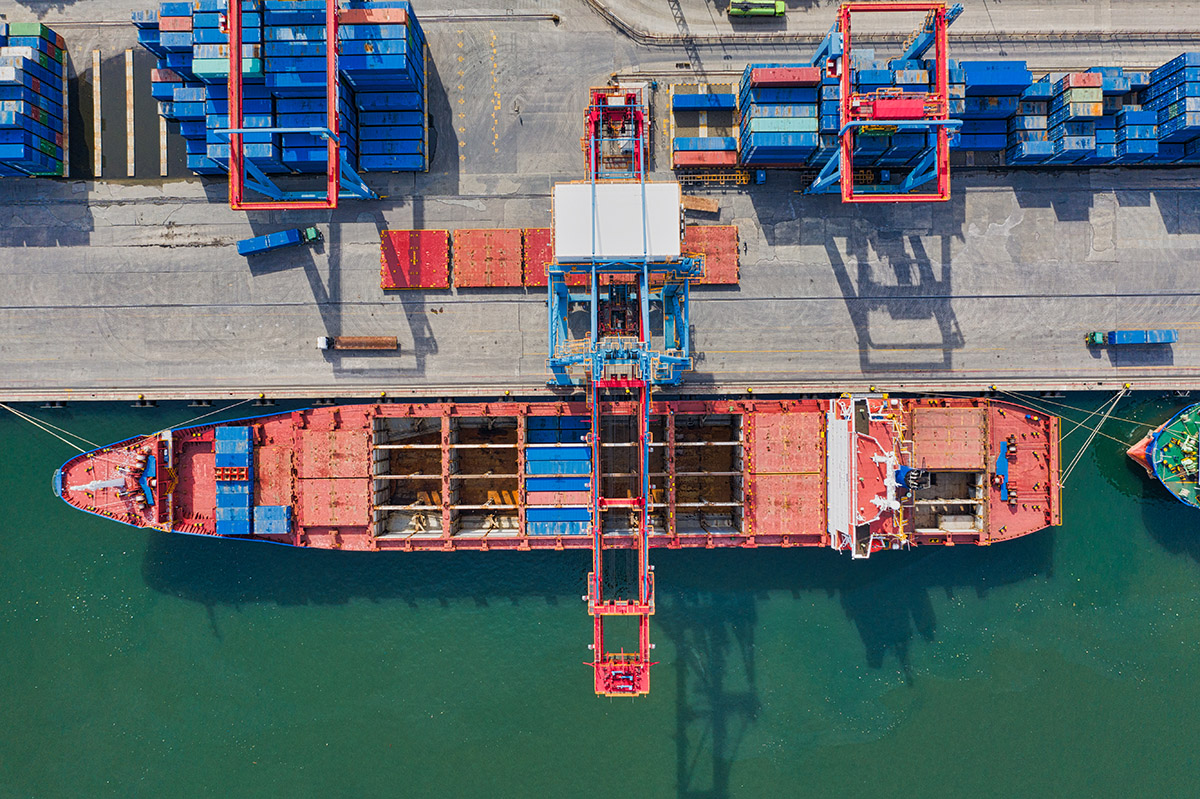

Danaos Corporation (NYSE: DAC) is one of the world’s largest container shipping companies, offering a range of seaborne transportation services. With the global economy recovering from the worst of the Coronavirus Pandemic, this is a top stock pick to consider in April.

Danaos Corporation (NYSE: DAC) is one of the world’s largest container shipping companies, offering a range of seaborne transportation services. With the global economy recovering from the worst of the Coronavirus Pandemic, this is a top stock pick to consider in April.

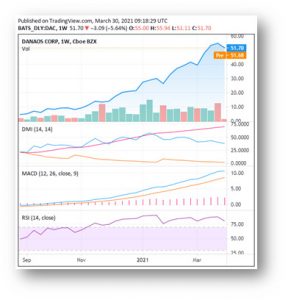

Danaos will benefit from increased trade and consumer spending this year. Analysts expect that earnings will grow by at least 28% over the next year, eclipsing the 17% growth recorded over the previous 12 months. As earnings increase, the stock is likely to strengthen, which could create strong returns for investors.

An average target price of $60.25 looks feasible considering the growth momentum in the year so far. A higher target of $67 (the highest recorded by FactSet today) is also reasonable. If global trade and shipping demand continues to increase at the current rate, it wouldn’t be surprising to see these estimates raised even more.

For the likelihood of a return over today’s stock price, Danaos is a difficult pick to ignore.

Key Data:

- 1 Year Price Growth: 1,192.50%

- YTD Price Growth: 25%

- 3 Month Price Growth: 30%

All information is based on current and historical market data, as well as publicly available financial data. As with any financial decision, your own research is important. Stock market outcomes can never be 100% accurately predicted. Familiarity with historical data, individual industries, and individual stocks is key to developing a robust portfolio. Note that stock prices can fluctuate rapidly during trading sessions.