Blue Shield is dropping CVS Health’s pharmacy services

CVS Health Corp (NYSE:CVS) is down 8.7% to trade at $66.43 at last check, after news that Blue Shield of California is dropping the retailer’s pharmacy services in favor of Mark Cuban’s Cost Plus Drugs and Amazon Pharmacy. The move will save its roughly 5 million members money on drug costs, and is pressuring other pharmacy benefit managers (PBM) lower as well.

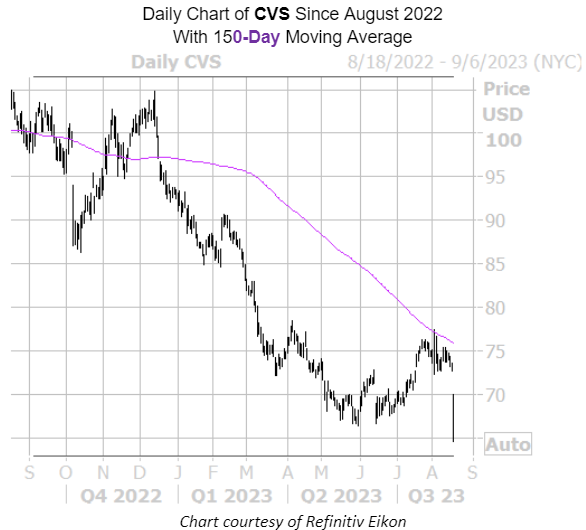

On the charts, CVS is headed for its fourth-straight daily loss, and earlier hit a more than two-year low of $64.63. Overhead pressure at its 150-day moving average guided the shares lower before today’s bear gap as well. Year-to-date, the equity is down 28.7%.

Options traders are chiming in on the news. So far, 88,000 calls and 76,000 puts have been exchanged, which is already four times the average daily options volume. The August 65 put is the most popular, with new positions being opened there.

Puts have been much more popular than usual in the options pits. At the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), CVS’ 10-day put/call volume ratio of 1.14 sits higher than 92% of readings from the past year.

Now could be a good time to weigh in with options, too. The security’s Schaeffer’s Volatility Scorecard (SVS) sits at an 85 out of 100, meaning CVS Health stock has exceeded option traders’ volatility expectations during the past year.

Image and article originally from www.schaeffersresearch.com. Read the original article here.