Lorraine Boogich/iStock Unreleased via Getty Images

Cruise line stocks surged on Wednesday after the July CPI print came in lighter than expected.

Carnival Corp. (NYSE:CCL) +9.61%, Royal Caribbean (NYSE:RCL) +9.34%, and Norwegian Cruise Line Holdings (NYSE:NCLH) +11.52% were the top three gainers in the entire S&P shortly before Wednesday’s close. The strong gains were motivated not only by a lighter hit to consumers that may consider booking a cruise, but a significant drop in fuel prices. Fuel oil and gas prices dropped 11% and 7.6%, respectively in the month of July.

Additionally, the hefty debt loads in the cruise sector appeared slightly less problematic as the odds of another 75 basis point rate hike fell significantly. Per the CME’s FedWatch tool, the odds of a 75 basis point hike fell to just 37.5% from 68% just a day prior. The indicator now predicts a 62.5% chance of a 0.5% hike in September.

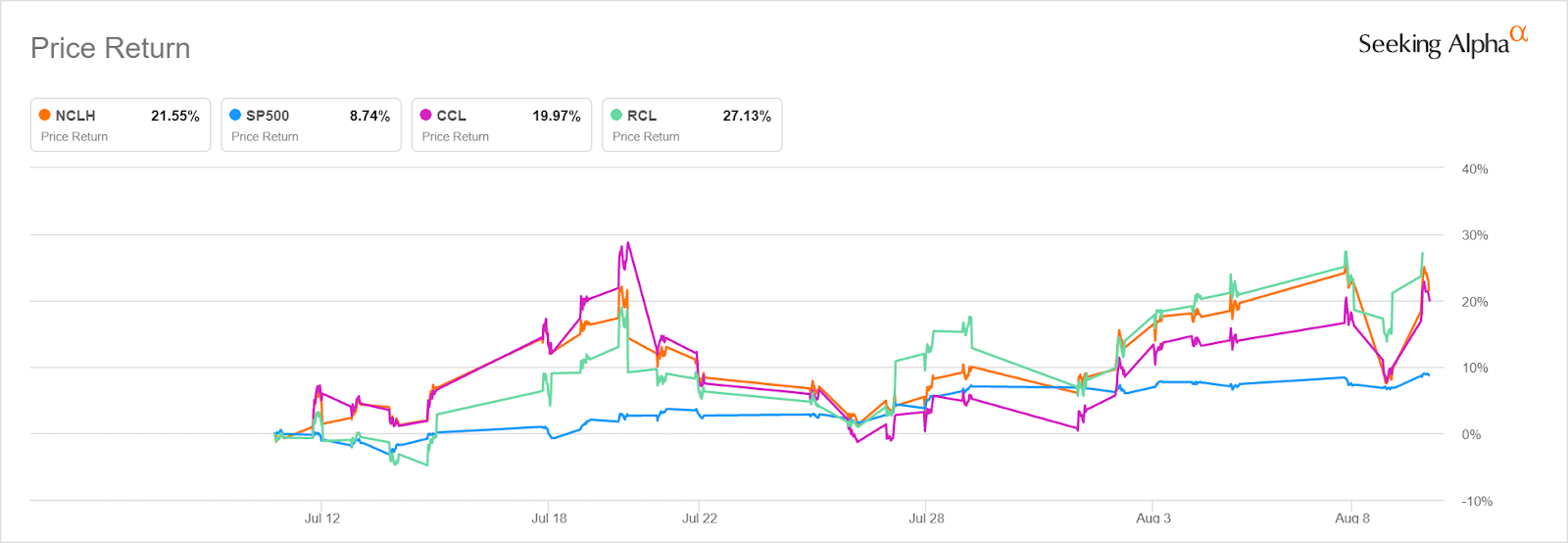

Despite significant declines in the past year, with each declining 40% or more in the first 8 months of 2022, cruise stocks have rebounded sharply in the past month. Despite volatile moves, each of the big three cruise operators has more than doubled the S&P’s rebound.

Read more on Norwegian Cruise Line’s latest earnings result that conversely sent the sector sliding on Tuesday.

Image and article originally from seekingalpha.com. Read the original article here.