Shares are pacing for their third-straight daily win

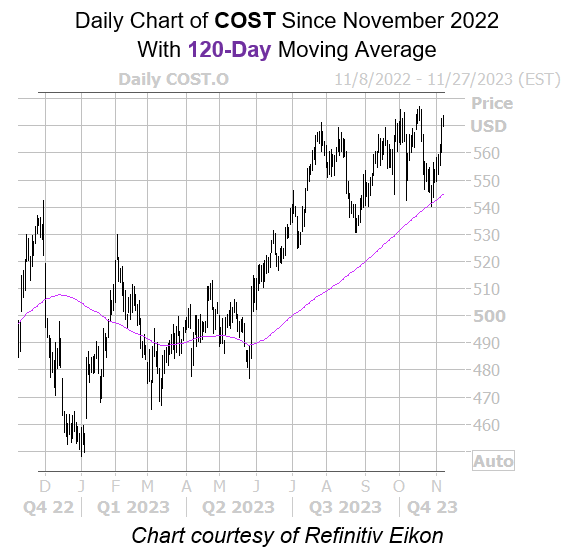

Costco Wholesale Corporation (NASDAQ: COST) stock is up 0.6% at $573.15 at last check, and on track for a third-straight win. The equity also sports a 25.6% year-to-date lead, and staged a bounce off its 120-day moving average. With help from a historically bullish trendline now flashing, the security could soon conquer fresh 52-week highs.

This is currently the case with the stock’s SVI of 19%, which sits in the 17th percentile of its annual range. Shares were higher one month after 71% of these signals, averaging a 3.6% pop. From its current trading level, a move of similar magnitude would place COST at $593.78 — its highest level since April 2022.

Options traders have been overwhelmingly bearish toward COST. At the International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), META sports a 10-day put/call volume ratio or 1.23 that stands in the 97th percentile of readings from the past year.

Echoing this, the stock’s Schaeffer’s put/call open interest ratio (SOIR) of 1.37 ranks in the 96th percentile of reading from the past 12 months. In other words, an unwinding of pessimism in the options pits could generate tailwinds for Costco stock moving forward.

Image and article originally from www.schaeffersresearch.com. Read the original article here.