Alphabet has joined growing list of tech giants announcing layoffs

Subscribers to Chart of the Week received this commentary on Sunday, January 22.

Google parent Alphabet Inc (NASDAQ:GOOGL) has joined the growing list of tech behemoths that are initiating sizable layoffs. CEO Sundar Pichai explained it by noting that the company had previously hired for “a different economic reality than the one we face today.” Some of the other big names taking the initiative toward laying off workers are Amazon.com (AMZN), Microsoft (MSFT), and Facebook parent Meta Platforms (META). It’s not just Big Tech, either; Salesforces (CRM), crypto-adjacent Coinbase (COIN), and even niche companies like Teladoc (TDOC) are all cutting costs by reducing their workforce.

GOOGL is also making noise in the options pits, appearing on Schaeffer’s Senior Quantitative Analyst’s list of S&P 400 (SP400) stocks that have attracted the highest weekly options volume within the last two weeks. Per White, Alphabet stock saw 1,883,919 calls and 2,414,110 puts exchanged over this 10-day period. The most popular was the January 2023 107.50 put, followed by the 125 put in the same series. As of this writing, GOOGL was last seen trading up 4% at $96.83.

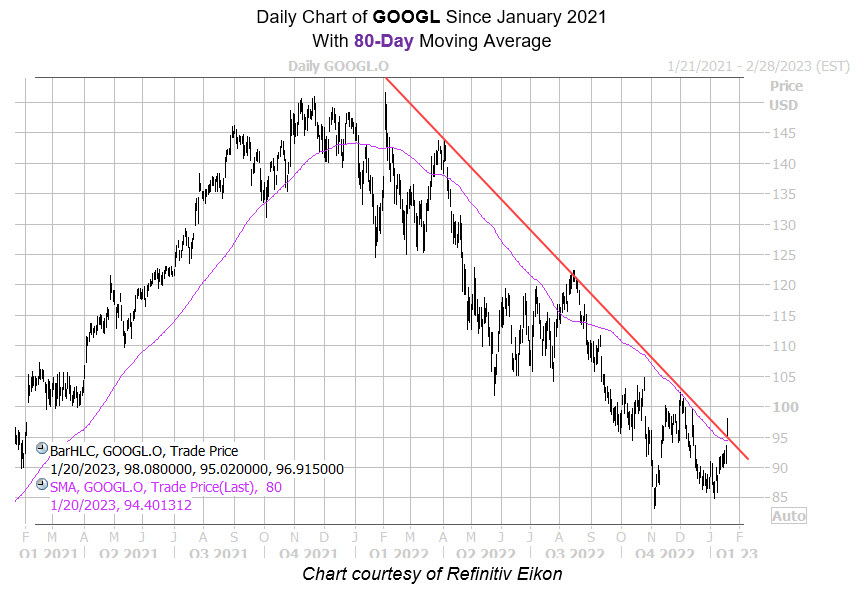

On Friday, GOOGL gapped higher on the heels of the layoff news, breaking above the long-term downtrend line that began at the equity’s February 2022 record peak of $151.54. Back in a supportive stance is the 80-day moving average, which has been a ceiling for the shares during the past several months but performed as long-term support in early 2021. Friday’s bull gap also has the shares sporting a nearly 10% year-to-date lead.

Data out of the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX) is showing more of a preference for calls in the longer term, which means Friday’s outperformance could be short-lived, should this bullish sentiment unwind. GOOGL’s 50-day call/put volume ratio comes in at 2.22, which is twice the amount of puts traded in the past 10 weeks and ranks in the 97th annual percentile.

In conclusion, while the barrage of layoffs may have a positive short-term outlook for the tech companies and their respective stock performance, a careful consideration of the risk v. reward is recommended when buying for the long term.

Image and article originally from www.schaeffersresearch.com. Read the original article here.