A historically bullish trendline could help the security resume its rally

CME Group Inc (NASDAQ:CME) stock is up 0.9% at $215.99 at last check, after the company announced third-quarter earnings that topped estimates, while revenue missed expectations. The stock attracted four price-target cuts, including one from UBS to $250 from $230.

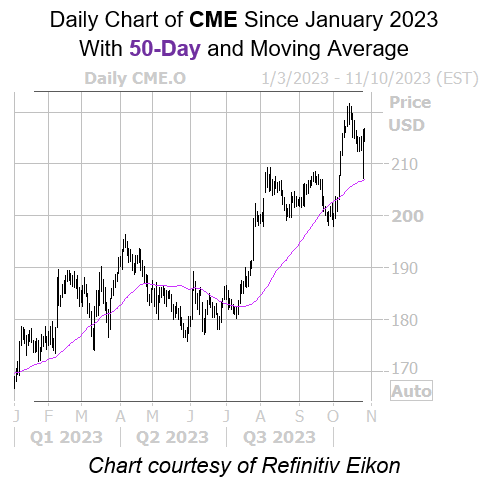

Plus, the security yesterday pulled back to a trendline with historically bullish implications. According to data from Schaeffer’s Senior Quantitative Analyst Rocky White, CME Group stock is within one standard deviation of its 50-day moving average. The equity saw at least six similar signals over the last three years, defined for this study as having traded north of the moving average 80% of the time in the past two months, and in eight of the last 10 trading days.

CME was higher one month later in 83% of those instances, with an average 3.3% gain. A move of similar magnitude from its current perch would place the security back above $223 for the first time since April 2022, overtaking its Oct. 13, one-year high of $221.76. The stock is already boasting a 28.5% year-to-date, with additional support at the $212 level.

While analysts are mostly bullish on the shares, there is still ample room for upgrades. Of the 13 firms in question, six still call the security a tepid “hold” or worse, indicating a sentiment shift could generate tailwinds.

Image and article originally from www.schaeffersresearch.com. Read the original article here.