The security looks ripe for a round of downgrades and/or price-target cuts

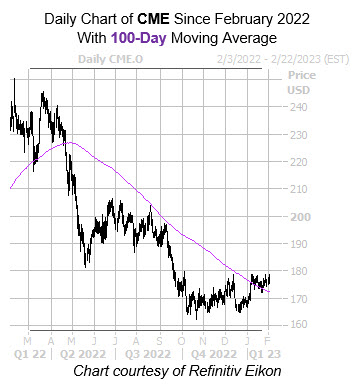

CME Group Inc (NASDAQ:CME) is up 1% to trade at $177.25 at last check. A floor at the $174 level has been supporting shares over the past week, but overhead pressure at the $180 area has been capping any positive price action since September. Shares might soon be testing that floor, though, and could add to their 23.7% year-over-year deficit as they come within striking distance of a trendline with historically bearish implications.

Additional headwinds could stem from a shift in analyst sentiment, given seven of the 13 in coverage still carry a “strong buy” rating on CME. In addition, the 12-month consensus target price of $200.82 is a 13.2% premium to current levels, leaving the door wide open for price-target cuts.

Image and article originally from www.schaeffersresearch.com. Read the original article here.