CLF is seeing support on the charts

The shares of Cleveland-Cliffs Inc (NYSE:CLF) are already down 12.1% since the start of the year. The equity has only closed higher three days this January, though checking off a fourth today if gains hold. At last glance, CLF was up 1.2% at $17.94, and potentially poised for a rebound.

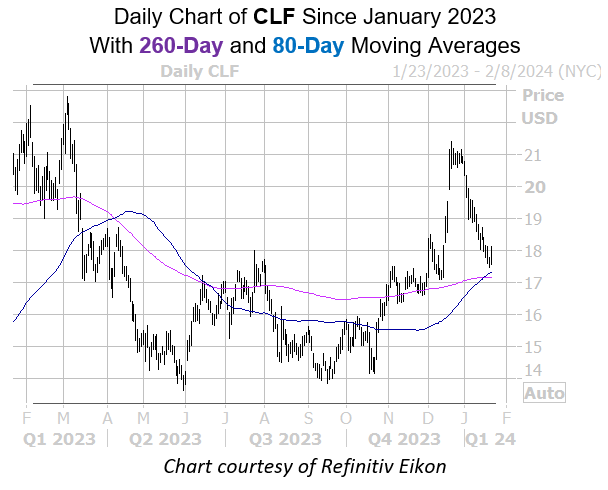

According to Schaeffer’s Senior Quantitative Analyst Rocky White, the recent pullback has CLF within one standard deviation of its 260-day moving average for the second time in the last three years. The stock was 14.6% higher one month later after the last signal. The equity has pulled back to its 80-day moving average for the seventh time in the last three years as well, with the stock closing higher one month later after three of those instances, averaging a 6.4% return.

Cleveland-Cliffs stock’s 14-day relative strength index (RSI) of 10.8 ranks firmly in “oversold” territory, which is typically indicative of a short-term bounce. Plus, short interest represents 5.9% of the stock’s available float.

Image and article originally from www.schaeffersresearch.com. Read the original article here.