Fintel reports that on June 2, 2023, Citigroup maintained coverage of NOV (NYSE:NOV) with a Buy recommendation.

Analyst Price Forecast Suggests 74.26% Upside

As of June 2, 2023, the average one-year price target for NOV is 25.81. The forecasts range from a low of 17.17 to a high of $36.36. The average price target represents an increase of 74.26% from its latest reported closing price of 14.81.

See our leaderboard of companies with the largest price target upside.

The projected annual revenue for NOV is 8,344MM, an increase of 9.06%. The projected annual non-GAAP EPS is 1.15.

NOV Declares $0.05 Dividend

On May 18, 2023 the company declared a regular quarterly dividend of $0.05 per share ($0.20 annualized). Shareholders of record as of June 16, 2023 will receive the payment on June 30, 2023. Previously, the company paid $0.05 per share.

At the current share price of $14.81 / share, the stock’s dividend yield is 1.35%.

Looking back five years and taking a sample every week, the average dividend yield has been 0.97%, the lowest has been 0.42%, and the highest has been 2.26%. The standard deviation of yields is 0.35 (n=165).

The current dividend yield is 1.08 standard deviations above the historical average.

Additionally, the company’s dividend payout ratio is 0.24. The payout ratio tells us how much of a company’s income is paid out in dividends. A payout ratio of one (1.0) means 100% of the company’s income is paid in a dividend. A payout ratio greater than one means the company is dipping into savings in order to maintain its dividend – not a healthy situation. Companies with few growth prospects are expected to pay out most of their income in dividends, which typically means a payout ratio between 0.5 and 1.0. Companies with good growth prospects are expected to retain some earnings in order to invest in those growth prospects, which translates to a payout ratio of zero to 0.5.

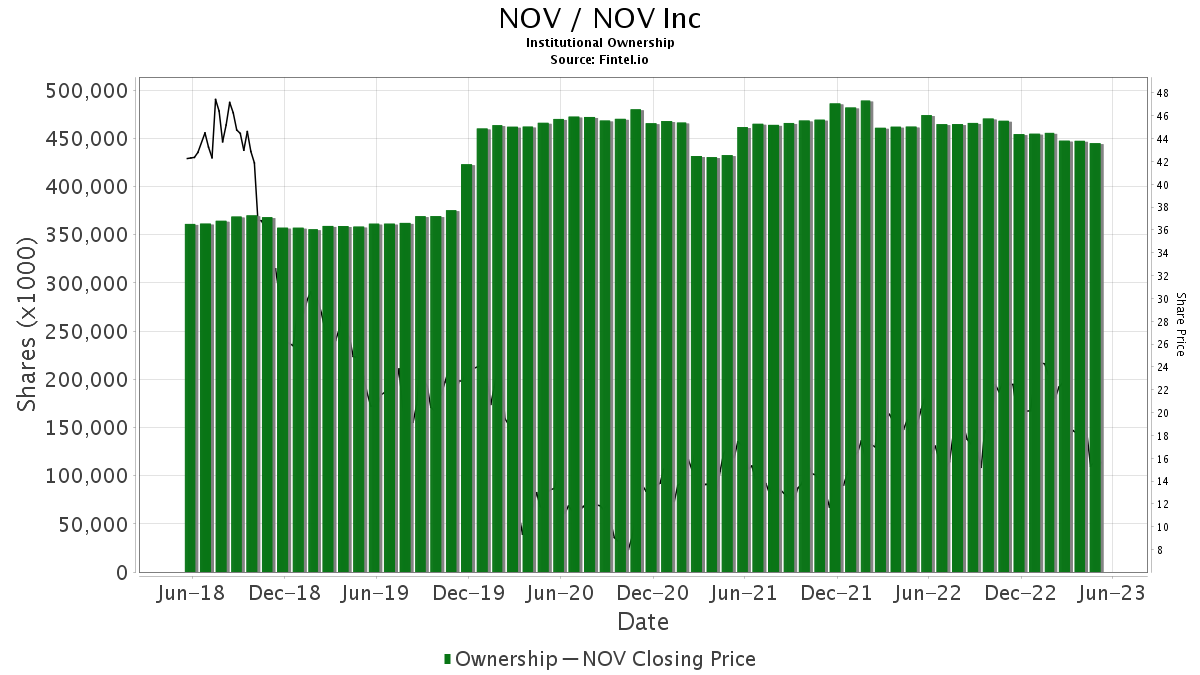

What is the Fund Sentiment?

There are 841 funds or institutions reporting positions in NOV. This is an increase of 28 owner(s) or 3.44% in the last quarter. Average portfolio weight of all funds dedicated to NOV is 0.32%, a decrease of 5.08%. Total shares owned by institutions decreased in the last three months by 0.52% to 445,159K shares. The put/call ratio of NOV is 0.44, indicating a bullish outlook.

What are Other Shareholders Doing?

First Eagle Investment Management holds 37,198K shares representing 9.45% ownership of the company. In it’s prior filing, the firm reported owning 37,173K shares, representing an increase of 0.07%. The firm decreased its portfolio allocation in NOV by 15.26% over the last quarter.

Pzena Investment Management holds 29,531K shares representing 7.50% ownership of the company. In it’s prior filing, the firm reported owning 29,569K shares, representing a decrease of 0.13%. The firm decreased its portfolio allocation in NOV by 14.04% over the last quarter.

SGENX – First Eagle Global Fund holds 26,905K shares representing 6.83% ownership of the company. No change in the last quarter.

Hotchkis & Wiley Capital Management holds 18,011K shares representing 4.57% ownership of the company. In it’s prior filing, the firm reported owning 17,357K shares, representing an increase of 3.63%. The firm decreased its portfolio allocation in NOV by 7.63% over the last quarter.

Ameriprise Financial holds 15,398K shares representing 3.91% ownership of the company. In it’s prior filing, the firm reported owning 15,244K shares, representing an increase of 1.00%. The firm decreased its portfolio allocation in NOV by 84.20% over the last quarter.

NOV Background Information

(This description is provided by the company.)

NOV delivers technology-driven solutions to empower the global energy industry. For more than 150 years, NOV has pioneered innovations that enable its customers to safely produce abundant energy while minimizing environmental impact. The energy industry depends on NOV’s deep expertise and technology to continually improve oilfield operations and assist in efforts to advance the energy transition towards a more sustainable future. NOV powers the industry that powers the world.

Key filings for this company:

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Image and article originally from www.nasdaq.com. Read the original article here.