CAT has grown over 10% in the past month

Caterpillar Inc. (NYSE:CAT) started off the month with a post-earnings bear gap, even despite the company’s top-line beat. Three weeks later, has the technical setup for the blue-chip changed?

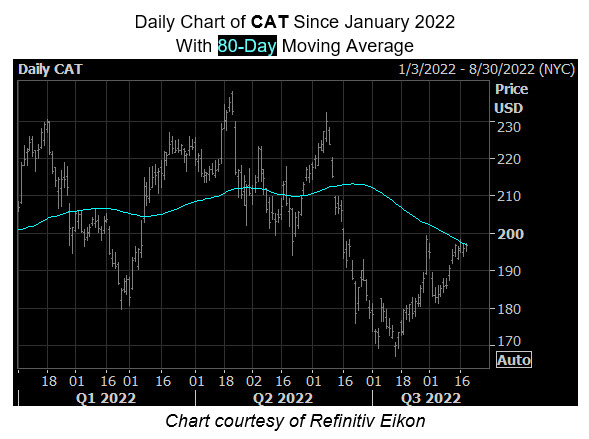

Caterpillar stock is up 10% this quarter alone, but the round-number $200 level has served as a ceiling this summer. The shares descending 80-day moving average is also keeping the rally in check.

Still, CAT provides a fair valuation at a forward price-earnings ratio of 15.80 and a price-sales ratio of 1.98. Caterpillar stock also offers a decent dividend yield of 2.43% at a forward dividend of $4.80, having paid a cash dividend every year since 1933. Moreover, CAT has paid higher annual dividends to shareholders for 28 consecutive years and is recognized as a member of the S&P 500 Dividend Aristocrat Index, making Caterpillar stock a safe option for long-term and dividend investors.

The construction and mining equipment company is expected to complete fiscal 2022 with 12.8% revenue growth and 15.9% earnings growth. CAT is also estimated to continue growing in fiscal 2023 with 5.4% revenue growth and 10.6% earnings growth, setting up Caterpillar stock as a solid play for the coming years.

Image and article originally from www.schaeffersresearch.com. Read the original article here.