Delta Airlines is among the first to report earnings in 2024

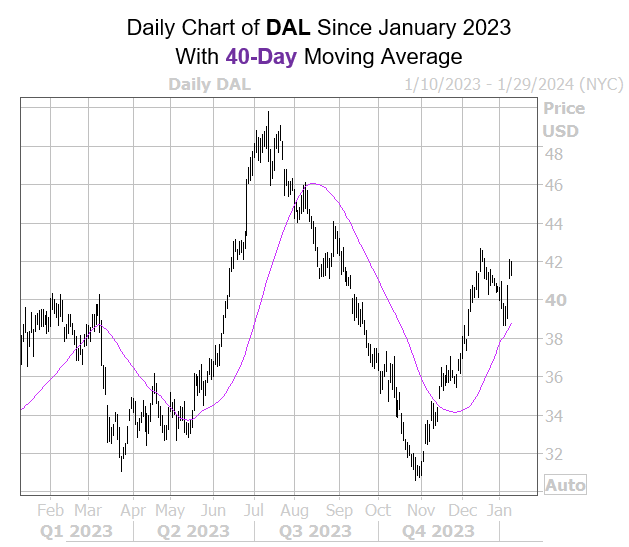

Delta Air Lines, Inc. (NYSE:DAL) is headed to the earnings confessional, with results for the fourth quarter due out before the open on Friday, Jan. 12. The security is today pacing for a third-straight daily gain, last seen up 0.7% at $41.94, as it bounces off a recent pullback to the 40-day moving average, after reaching its highest level since September in December. Over the last 12 months, DAL added more than 14%.

The airline stock doesn’t have the best track record when it comes to post-earnings reactions, though. DAL finished five of the past eight next-day sessions lower, including a 2.3% drop in October. The shares averaged a move of 3% during the past two years, regardless of direction, but the options pits are pricing in a larger-than-usual swing of 6.1% this time.

Options bulls have been overwhelmingly confident of late, per DAL’s 50-day call/put volume ratio of 3.91 over at the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX) that ranks higher than all but 4% of readings from the past year.

Options look like a good way to go when weighing in on Delta Airlines stock, since its elevated Schaeffer’s Volatility Scorecard (SVS) of 97 out of 100 means it tends to exceed volatility expectations.

Image and article originally from www.schaeffersresearch.com. Read the original article here.