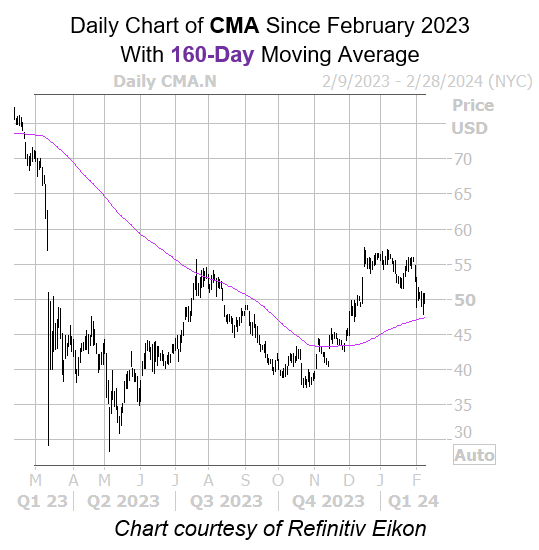

The 160-day moving average could play a key role soon

According to data from Schaeffer’s Senior Quantitative Analyst Rocky White, Comerica stock is within one standard deviation of its 160-day trendline. Shares saw three similar signals during the past three years, defined for this study as having traded north of this trendline 80% of the time over the last two months, and in eight of the past 10 trading days.

Shares moved higher one month later after each of those instances, with an average 8.2% pop. A move of similar magnitude from its current perch would place the equity back above $54.

Options are affordably priced at the moment. This is per Comerica stock’s Schaeffer’s Volatility Index (SVI) of 43% that sits higher than 13% of annual readings, suggesting these traders are currently pricing relatively low volatility expectations.

It’s worth noting that the security’s Schaeffer’s Volatility Scorecard (SVS) ranks at 94 out of 100. This means CMA has exceeded option traders’ volatility expectations during the past year — a boon for options buyers.

Image and article originally from www.schaeffersresearch.com. Read the original article here.