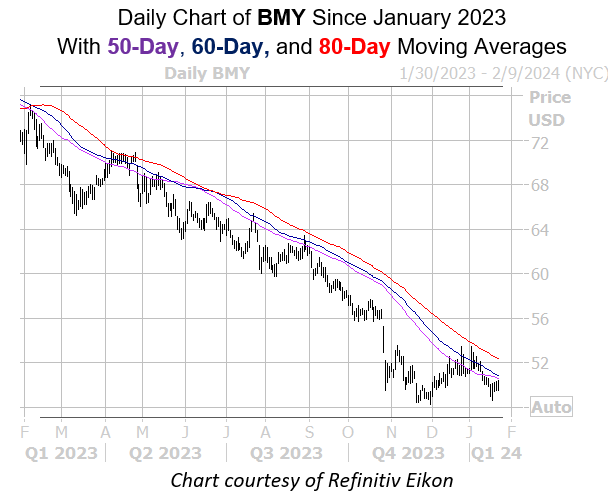

BMY has pulled back to two historically bearish trendlines

After eight-straight monthly losses starting in April 2023, the shares of pharmaceutical concern Bristol-Meyers Squibb Co (NYSE:BMY) started to rebound in December, though were swiftly rejected by the 80-day moving average at the start of the year. Now, it looks like that bounce was indeed short-lived, as BMY is seeing even more pressure on the charts after its recent dip.

According to Schaeffer’s Senior Quantitative Analyst Rocky White, Bristol-Meyers stock is within one standard deviation of its 50-day and 60-day moving averages. The equity has seen six similar signals from its 60-day trendline, after which the stock was negative one month later every time, averaging a 4.8% loss. Its 60-day trendline has seen seven other signals, and the stock was negative one month later 86% of the time, averaging a 3.5% drop.

Short interest has been unwinding, down 17.9% over the last month, now representing a slim 1.1% of the stock’s available float. The stock failed to capitalize on the short covering, however, indicating technical weakness.

Image and article originally from www.schaeffersresearch.com. Read the original article here.