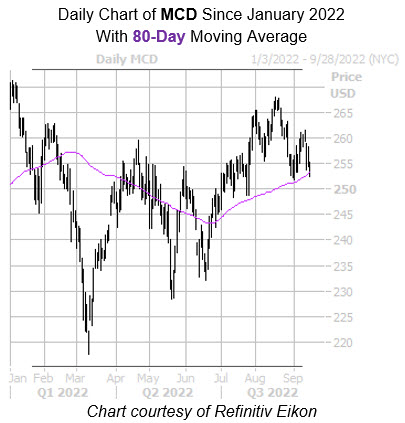

The security has pulled back to a historically bullish trendline

Blue-chip concern McDonald’s Corp (NYSE:MCD) is down 0.5% to trade at $254.46 at last check, but it looks as though this pullback may be only temporary. Shares are today testing a floor at the $252 level — which contained a dip earlier this month as well. The equity may soon trim its 5% year-to-date deficit, though, given MCD just neared a trendline with historically bullish implications.

Specifically, McDonald’s stock is within one standard deviation of its 80-day moving average, per Schaeffer’s Senior Quantitative Analyst Rocky White’s latest study. The security has seen six similar signals in the last three years, and was higher one month later 80% of the time, averaging a 3.5% gain. A comparable move from its current perch would place MCD back above the $263 level.

An unwinding of pessimism in the options pits could create additional tailwinds for the equity. At the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), the stock’s 10-day put/call volume ratio of 1.57 ranks higher than 92% of readings from the past year. This means puts are getting picked up at a much faster-than-usual clip.

Echoing this, McDonald’s stock’s Schaeffer’s put/call open interest ratio (SOIR) of 1.42 ranks in the 85th percentile of readings from the last 12 months, suggesting these short-term options traders have rarely been more put-biased.

Image and article originally from www.schaeffersresearch.com. Read the original article here.