Call traders are blasting the Bitcoin-adjacent stock in response

Marathon Digital Holdings Inc (NASDAQ:MARA) was last seen up 11.7% to trade at $9.55 at last check, as Bitcoin’s (BTC) surge to 18-month highs props up the entire cryptocurrency sector. Marathon Digital also reported better-than-expected third-quarter earnings after yesterday’s close, though revenue missed the mark. Sector peers are enjoying the halo lift, but not as much as MARA; Coinbase (COIN) is 5.9% higher at last check, while Microstrategy (MSTR) is up 5.4%.

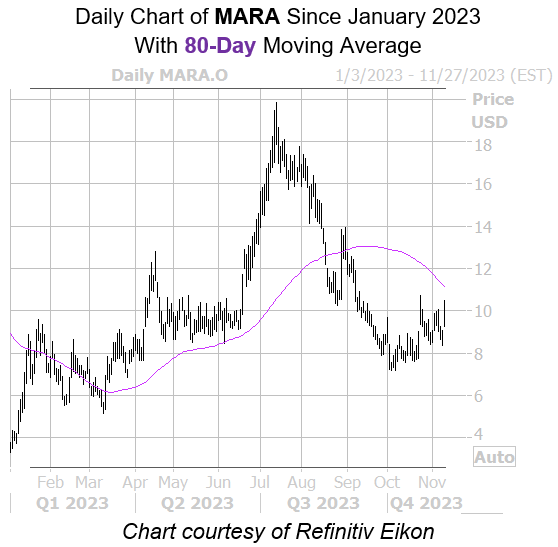

Despite today’s surge, the $11 region is starting to emerge as a short-term top, after rejecting a previous rally in late October. This area also coincides with the shares’ downward sloping 80-day moving average. Nevertheless, MARA is poised to snap a three-day losing streak today, and sports a 177.7% lead for 2023.

Options volume today is running at triple the intraday average amount, with 380,000 calls and 81,000 puts across the tape so far. Most popular is the weekly 11/10 10-strike call, followed by the 10.50-strike call in that same series, with new positions being bought to open at both.

Bullish bets are nothing new to options traders, per the equity’s 50-day call/put volume ratio of 2.76 at the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX) ranks higher than 98% of annual readings. This indicates long calls have been getting picked up at a much quicker-than-usual clip.

It’s also worth noting the security’s Schaeffer’s Volatility Scorecard (SVS) sits at 82 out of 100, suggesting it has exceeded option traders’ volatility expectations in the last year.

Image and article originally from www.schaeffersresearch.com. Read the original article here.