Behind the slew of Big Tech earnings reports for Q2

Subscribers to Chart of the Week received this commentary on Sunday, August 6.

Second-quarter earnings season shifted into its fifth and (mostly) final gear this week, rounding out a long list of Big Tech reports that have gripped investor attention. A few weeks ago we mentioned that the tech sector may start to cool in the coming months. However, recent post-earnings performance suggests a flatline may be further off than originally thought. Below, we’ll untangle the pile of Big Tech earnings from the past few weeks, as well as take the temperature of how options traders are reacting.

For the sake of this article, “Big Tech” accounts for Amazon.com (AMZN), Apple (AAPL), Alphabet (GOOGL), Meta Platforms (META), and Microsoft (MSFT). The day of this writing, Amazon.com stock is enjoying a post-earnings surge of more than 9% to trade at $142.90, thanks to better-than-expected second-quarter results stemming from Amazon Web Services’ (AWS) sales. More than 20 brokerage firms chimed in with bull notes in response, and now the shares are eyeing their best single-session gain since November.

Apple on the other hand, has not been as lucky, seeing a nearly 3% drop in Friday trading to settle near $185, after Thursday evening reporting weak fiscal third-quarter iPhone sales. Revenue was also lower year-over-year, and the chip giant expects the grim performance to continue through the current quarter. Today’s bear gap has the equity set to close below its 50-day trendline for the first time since January.

Facebook parent Meta Platforms (META) reported after the closing bell on Wednesday, July 26 and subsequently enjoyed a 4.4% post-earnings pop. This surge sent the shares to a more than one-year peak, with an earnings and revenue beat, as well as fresh Artificial Intelligence (AI) buzz. The company also released Threads earlier in July, which resulted in increased albeit waning public exposure as an alternative to rival Twitter, or X.

Software stock Microsoft posted a fiscal fourth-quarter earnings and revenue win in late-July, but was an anomaly in the post-earnings tech surge, dropping 3.8% for its subsequent session. While longer-term MSFT has enjoyed significant growth, recent months have dragged the security into a series of higher lows, alongside a slim deficit for the new quarter. MSFT is trading at $330.53 as of this writing.

Last, but certainly not least, Google guardian Alphabet cheered an earnings beat on the same day as its aforementioned peer and enjoyed an impressive 5.8% next-session gain. GOOGL is sporting a nearly 50% year-to-date lead, and at last glance was up 1.2% at $130, riding the final stretch of the Big Five, post-earnings wave.

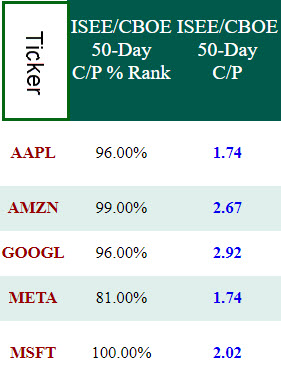

Enjoying the slew of these post-earnings performances has been options traders, with bulls ruling the roost over the last 10 weeks — indicating that speculators are betting on tech remaining red-hot. Per the table below, data from the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), shows all five tech giants’ 50-day call/put volume ratios standing at 1.74 or higher, all ranking in the 81st annual percentile or above.

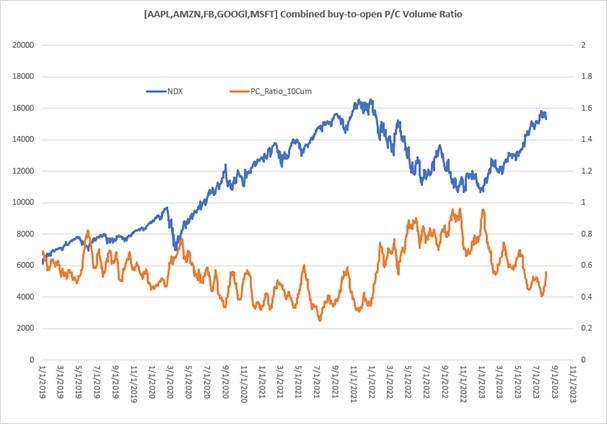

However, Schaeffer’s Senior Market Analyst Chris Prybal pulled a reading of the Big Five’s combined buy-to-open put/call ratio. Per the chart below, the ratio bottomed out on July 20 at 0.40, but on August 3, ran up to its highest mark since May 23, 0.56. In other words, put traders are growing a little bolder with the uncertainty and volatility of earnings in the rear view.

Image and article originally from www.schaeffersresearch.com. Read the original article here.