Here are three stocks with buy rank and strong value characteristics for investors to consider today, October 21st:

Movado Group MOV: This company which is one of the world’s premier watchmakers that designs, manufactures and distributes watches, carries a Zacks Rank #1(Strong Buy), and has witnessed the Zacks Consensus Estimate for its current year earnings increasing 1.0% over the last 60 days.

Movado Group Inc. Price and Consensus

Movado Group Inc. price-consensus-chart | Movado Group Inc. Quote

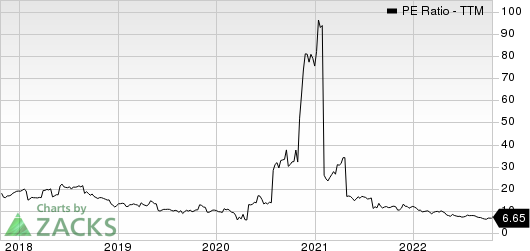

Movado Group has a price-to-earnings ratio (P/E) of 7.19 compared with 16.0 for the industry. The company possesses a Value Score of A.

Movado Group Inc. PE Ratio (TTM)

Movado Group Inc. pe-ratio-ttm | Movado Group Inc. Quote

Ryerson RYI: This company which is a global manufacturer of bearings, friction management products, and mechanical power transmission components, carries a Zacks Rank #1, and has witnessed the Zacks Consensus Estimate for its current-year earnings increasing 3.2% over the last 60 days.

Ryerson Holding Corporation Price and Consensus

Ryerson Holding Corporation price-consensus-chart | Ryerson Holding Corporation Quote

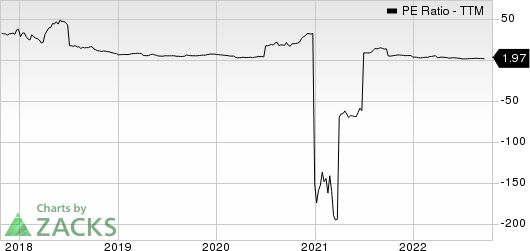

Ryerson’s has a price-to-earnings ratio (P/E) of 2.35 compared with 5.40 for the industry. The company possesses a Value Score of A.

Ryerson Holding Corporation PE Ratio (TTM)

Ryerson Holding Corporation pe-ratio-ttm | Ryerson Holding Corporation Quote

Danaos DAC: This company which is a leading international owner of containerships, chartering vessels to many of the world’s largest liner companies, carries a Zacks Rank #1, and has witnessed the Zacks Consensus Estimate for its current year earnings increasing 0.4% over the last 60 days.

Danaos Corporation Price and Consensus

Danaos Corporation price-consensus-chart | Danaos Corporation Quote

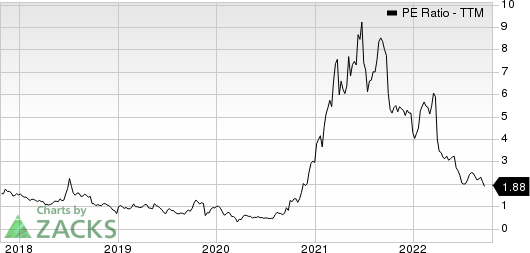

Danaos has a price-to-earnings ratio (P/E) of 2.07 compared with 11.0 for the industry. The company possesses a Value Score of A.

Danaos Corporation PE Ratio (TTM)

Danaos Corporation pe-ratio-ttm | Danaos Corporation Quote

See the full list of top ranked stocks here.

Learn more about the Value score and how it is calculated here.

Free Report Reveals How You Could Profit from the Growing Electric Vehicle Industry

Globally, electric car sales continue their remarkable growth even after breaking records in 2021. High gas prices have fueled his demand, but so has evolving EV comfort, features and technology. So, the fervor for EVs will be around long after gas prices normalize. Not only are manufacturers seeing record-high profits, but producers of EV-related technology are raking in the dough as well. Do you know how to cash in? If not, we have the perfect report for you – and it’s FREE! Today, don’t miss your chance to download Zacks’ top 5 stocks for the electric vehicle revolution at no cost and with no obligation.>>Send me my free report on the top 5 EV stocks

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Movado Group Inc. (MOV): Free Stock Analysis Report

Danaos Corporation (DAC): Free Stock Analysis Report

Ryerson Holding Corporation (RYI): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Image and article originally from www.nasdaq.com. Read the original article here.