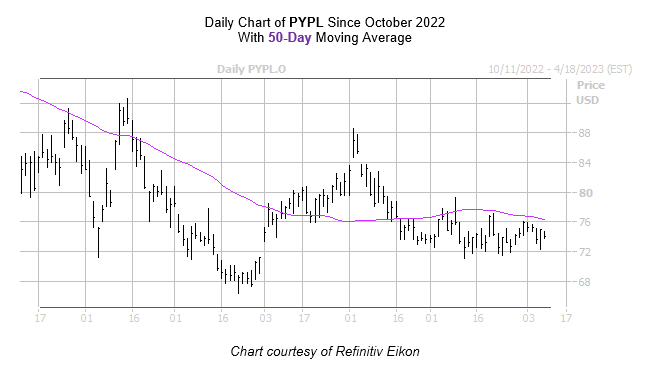

PayPal stock is trading near its historically bearish 50-day trendline

PayPal Holdings Inc (NASDAQ PYPL) has found a floor at the $72 level in recent weeks, and is holding onto a 4% year-to-date lead. However, the shares are 2% lower this afternoon to trade at $73.50, and trading near a historically bearish trendline that could add pressure in the coming weeks.

More specifically, PayPal stock just came within one standard deviation of its 50-day moving average. According to data from Schaeffer’s Senior Quantitative Analyst Rocky White, at least six similar signals have occurred in the past three years. PayPal stock turned negative one month later in 77% of those cases, averaging an 7.2% dip. From its current perch, a move of similar magnitude would put PYPL not only below the $72 area, but beneath $69 as well — its lowest level since December.

An unwinding of analysts’ optimism could add even more headwinds. Of the 31 in coverage, 23 rate the shares a “strong buy” or “buy.” Plus, the 12-month average target price of $100.81 is a 36.4% premium to PYPL’s current level of trading. This indicates that downgrades and/or price-target cuts are overdue.

Options look to be an attractive route to go. Specifically, PayPal stock’s Schaeffer’s Volatility Index (SVI) of 35% ranks in the lowest percentile of the last 12 months. What’s more, its Schaeffer’s Volatility Scorecard (SVS) is incredibly low right now, sitting at 21 out of 100. In simpler terms, the security is a prime selling candidate.

Image and article originally from www.schaeffersresearch.com. Read the original article here.