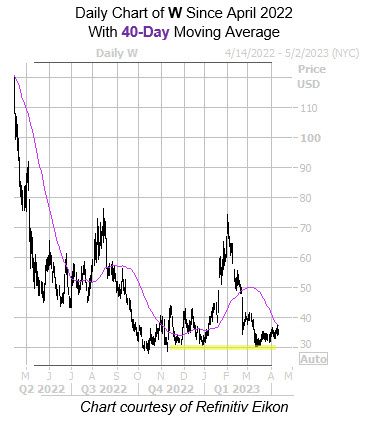

The 40-day moving average has been pressuring W since late February

Wayfair Inc (NYSE:W) stock is up 3.3% to trade at $35.18 at last check, bouncing off a floor at the $30 region. A historically bearish trendline that has been in place since a late February bear gap recently turned down the equity’s latest rally, though, and may further pressure it into its already steep 69.7% year-over-year deficit.

The trendline in question is Wayfair stock’s 40-day moving average. Per Schaeffer’s Senior Quantitative Analyst Rocky White’s latest study, W saw six similar signals during the last three years, and was higher one month later 83% of the time to average a 4.9% decline. A comparable move from its current perch would place shares back below $34.

Short sellers are firmly in control, despite short interest dipping 4.8% in the most recent reporting period. The 24.14 million shares sold short now make up 31.6% of the stock’s available float.

The options pits also lean bearish. At the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), Wayfair stock’s 50-day put/call volume ratio of 1.75 sits higher than 86% of readings from the last 12 months.

Premiums are reasonably priced right now, per W’s Schaeffer’s Volatility Index (SVI) of 86% that sits in the 6th percentile of its annual range. This means options traders are pricing in low volatility expectations at the moment — a boon for options buyers.

Image and article originally from www.schaeffersresearch.com. Read the original article here.