Fintel reports that on May 12, 2023, Barclays maintained coverage of Edgewell Personal Care (NYSE:EPC) with a Underweight recommendation.

Analyst Price Forecast Suggests 9.34% Upside

As of May 11, 2023, the average one-year price target for Edgewell Personal Care is 48.35. The forecasts range from a low of 38.38 to a high of $55.65. The average price target represents an increase of 9.34% from its latest reported closing price of 44.22.

See our leaderboard of companies with the largest price target upside.

The projected annual revenue for Edgewell Personal Care is 2,212MM, a decrease of 0.73%. The projected annual non-GAAP EPS is 2.42.

What is the Fund Sentiment?

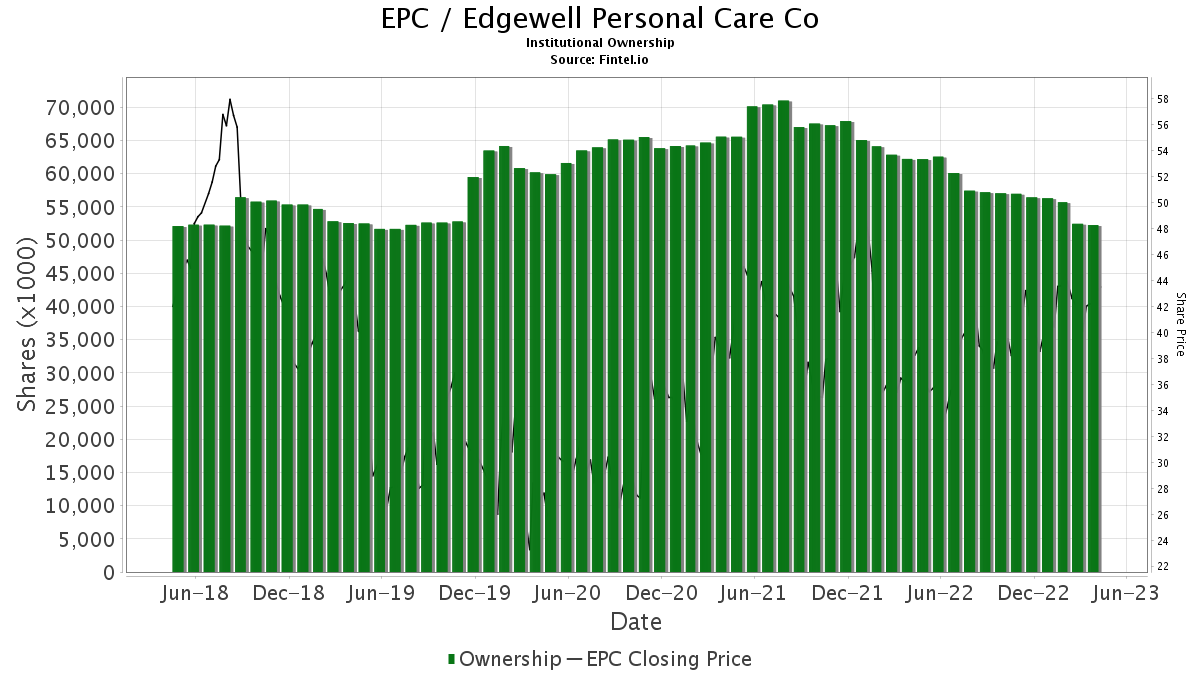

There are 532 funds or institutions reporting positions in Edgewell Personal Care. This is an increase of 22 owner(s) or 4.31% in the last quarter. Average portfolio weight of all funds dedicated to EPC is 0.16%, a decrease of 4.61%. Total shares owned by institutions decreased in the last three months by 7.17% to 51,779K shares. The put/call ratio of EPC is 1.18, indicating a bearish outlook.

What are Other Shareholders Doing?

IJR – iShares Core S&P Small-Cap ETF holds 3,840K shares representing 7.47% ownership of the company. In it’s prior filing, the firm reported owning 3,790K shares, representing an increase of 1.31%. The firm decreased its portfolio allocation in EPC by 5.01% over the last quarter.

American Century Companies holds 2,879K shares representing 5.60% ownership of the company. In it’s prior filing, the firm reported owning 2,891K shares, representing a decrease of 0.40%. The firm increased its portfolio allocation in EPC by 5.72% over the last quarter.

ASVIX – Small Cap Value Fund Investor Class holds 2,375K shares representing 4.62% ownership of the company. In it’s prior filing, the firm reported owning 2,500K shares, representing a decrease of 5.26%. The firm decreased its portfolio allocation in EPC by 7.66% over the last quarter.

Credit Agricole S A holds 1,992K shares representing 3.87% ownership of the company. In it’s prior filing, the firm reported owning 1,514K shares, representing an increase of 24.01%. The firm decreased its portfolio allocation in EPC by 99.74% over the last quarter.

APG Asset Management N.V. holds 1,753K shares representing 3.41% ownership of the company. In it’s prior filing, the firm reported owning 1,505K shares, representing an increase of 14.11%. The firm increased its portfolio allocation in EPC by 31.64% over the last quarter.

Edgewell Personal Care Background Information

(This description is provided by the company.)

Edgewell is a leading pure-play consumer products company with an attractive, diversified portfolio of established brand names such as Schick® and Wilkinson Sword® men’s and women’s shaving systems and disposable razors; Edge® and Skintimate® shave preparations; Playtex®, Stayfree®, Carefree® and o.b.® feminine care products; Banana Boat®, Hawaiian Tropic®, Bulldog®, Jack Black® and Cremo® sun and skin care products; and Wet Ones® moist wipes. The Company has a broad global footprint and operates in more than 50 markets, including the U.S., Canada, Mexico, Germany, Japan, the U.K. and Australia, with approximately 5,800 employees worldwide.

See all Edgewell Personal Care regulatory filings.

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Image and article originally from www.nasdaq.com. Read the original article here.