The security could bounce off a historically bullish trendline

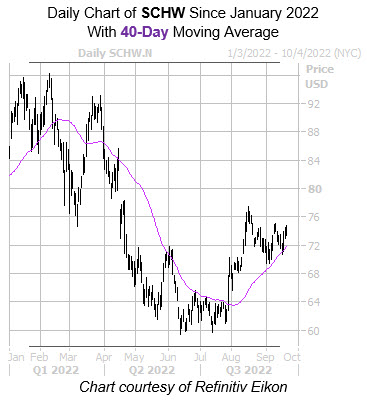

Charles Schwab Corporation (NYSE:SCHW) was last seen up 0.4% to trade at $73.66, adding to its 16.5% quarter-to-date lead. The security remains down 12.5% in 2022, however, as it struggles with a ceiling at the $75 area, which emerged after the stock’s August rally lost steam at the $77 region. It looks like shares may soon topple this area of resistance, though, as SCHW just pulled back to a trendline with historically bullish implications.

According to Schaeffer’s Senior Quantitative Analyst Rocky White’s latest study, Charles Schwab stock is within one standard deviation of its 40-day moving average. The equity has seen seven similar signals in the last three years, and was higher one month later 71% of the time, averaging an 8.1% gain. A move of similar magnitude would place SCHW above the $79 level for the first time since April.

Though analysts are already mostly optimistic towards Charles Schwab stock, there’s still some room for upgrades. Of the 14 analysts in coverage, four still call the equity a tepid “hold.”

Image and article originally from www.schaeffersresearch.com. Read the original article here.