NKE isn’t even in the top 25 stocks of XRT’s holdings

Subscribers to Chart of the Week received this commentary on Sunday, January 7.

The stock market fumbled the handoff from 2023 to 2024, and a lot of investors were caught off guard. While bulls in the American Association of Individual Investors (AAII) fell last week from 52.9% to 46.3%, the number that ended 2023 is still in the 81st percentile of its annual range. All 46.3% of those bulls are probably looking at this first week of 2024 with bewilderment. Mr. Rogers said to ‘look for the helpers,’ when daunting things appeared on the television that looked scary. But since we’ve graduated from the neighborhood to the Street, as investors facing an unexpected drawdown, let’s revise the phrase to: ‘look for the entry points.’

Amid a mostly malaise-filled start to 2024, one piece of optimistic news stood out from the retail sector. Retailer Costco Wholesale (COST) on Thursday night reported same-store sales in December that were up 3.5% from November, while net sales rose 10% for the month. Oppenheimer and Jefferies both hiked their price targets in response, to $695 and $755, respectively. COST added 1.4% in response, initially one of the only stocks in the black on Friday morning, until the broader market eventually caught up. That’s because Costco’s encouraging numbers are encouraging not just for the individual equity but also a good omen for the entire sector’s holiday shopping season.

This is the first sign from the holiday shopping season that the general consumer environment is a little more resilient than pundits suggest. And if more retailers follow Costco’s lead in the coming earnings season, it could mean outsized post-earnings moves on the horizon. Costco earnings won’t come out until March, while the bulk of the sector reports in mid-February. That’s a lot of time for stocks to correct their current course, of course, but that doesn’t discount today’s data serving as a potentially bullish smoking gun.

Seasonality could also work in the retail sector’s favor. Per data from Schaeffer’s Senior Quantitative Analyst Rocky White the SPDR S&P Retail (XRT) exchange traded fund (ETF) is one of the best performing ETFs in January, going back 10 years. While XRT has seen positive monthly returns during this time period only four out of ten times, the average return is a healthy 3.9%, the third-best of the ETF’s tracked. Given XRT’s 3.2% deficit already in 2024, how the sector responds in the next three weeks could be a barometer for future performance.

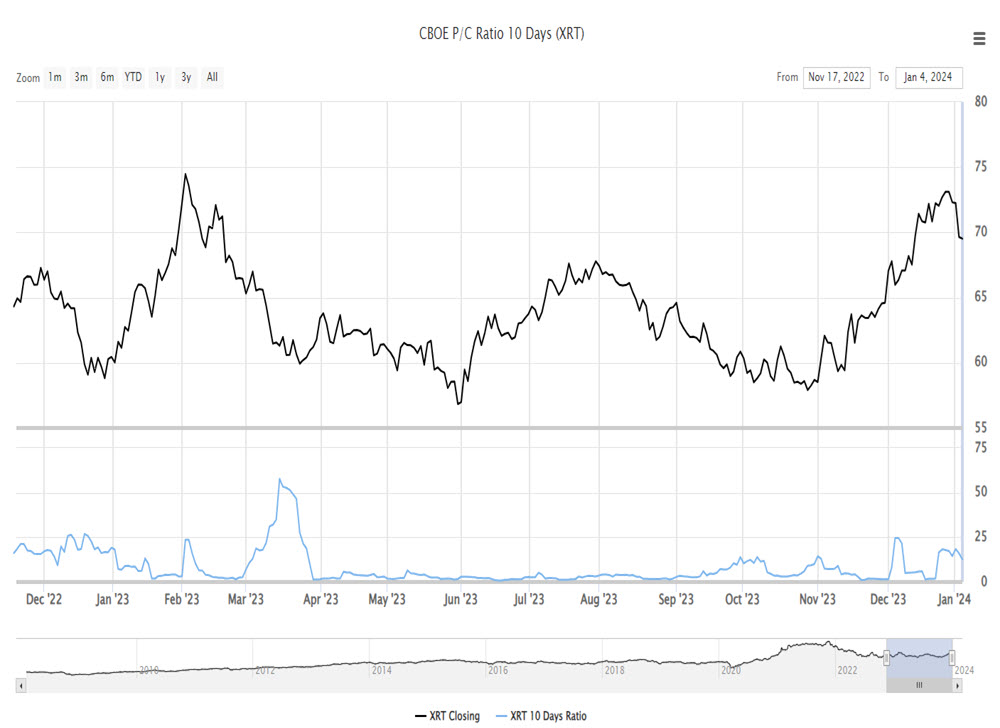

Put traders are crowding the retail ETF. At the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), XRT sports a 10-day put/call volume ratio of 12.73 that sits higher than 86% of readings from the past 12 months. That’s an awful lot of pessimism for an ETF that’s up 15% year-over-year, especially when in late November, in this very space we highlighted the increased XRT call skew.

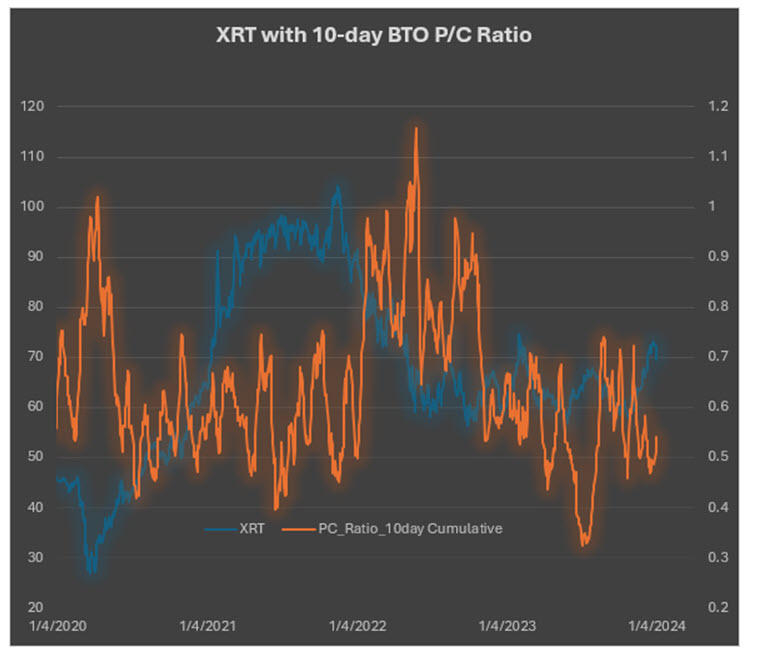

Digging deeper, the cumulative bought to open (BTO) put/call ratios of the 25 components within the XRT are also on the rise, per the chart below. They’re still outflanked by calls, but the curling up of the orange reflects the broader retail sector sentiment shift.

Maybe it was Nike (NKE) cutting its annual sales forecast just before Christmas, sending sports specialty retailers Dick’s Sporting Goods (DKS), Under Armor (UAA), and other peers spiraling. NKE itself has taken a 10% haircut since the announcement. Fast forward to Thursday, and NKE and Foot Locker (FL) slipped again, this time after UK-based sports retailer JD Sports lowered its own fiscal year profit forecast. Yet at the same time, NKE isn’t even in the top 25 stocks of XRT’s holdings. The plot thickens!

Whether you’re inclined to put more stock in two sports retailers downwardly revising their forecasts or Costco’s encouraging numbers, the next shoe to drop will be Jan. 17, when retail sales for December come out. If those numbers come in better than expected, it could be a green light to start sorting through the retail stock discount bin.

Image and article originally from www.schaeffersresearch.com. Read the original article here.